ARTICLES LABELLED WITH TAG cee

18

Mar

2020

Mar

2020

Immofinanz CEO leaves the company

Oliver Schumy, the CEO of Immofinanz AG, is leaving the Company as member of the Executive Board on 18 March 2020. The premature termination is based on mutual agreement due to personal reasons. As of 19 March 2020, the Executive Board of the Company is thus composed of the members Dietmar Reindl and Stefan Schönauer, who will continue all agendas.

Read more >

16

Mar

2020

Mar

2020

Globalworth announces Board changes and issues COVID-19 statement

Globalworth announced changes to the Company's Board of Directors and an update regarding the COVID-19 outbreak. Ioannis Papalekas, the Founder, is stepping down from the Board of Directors of Globalworth but will remain as CEO. Dimitris Raptis, the current Chief Investment Officer and Deputy CEO, has been appointed co-CEO.

Read more >

13

Mar

2020

Mar

2020

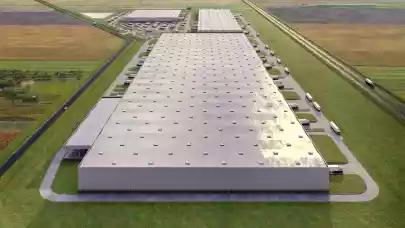

Goodman to sell entire CEE portfolio to GLP

In line with Goodman's strategy to focus its portfolio on gateway cities and major urban consumer markets in Continental Europe, the Goodman European Partnership and Goodman Group have signed an agreement for the sale of assets in Central and Eastern Europe for approximately €1 billion to global investment manager GLP. The transaction, which is subject to regulatory approval, includes properties located in Poland, Hungary, Czech Republic and Slovakia.

Read more >

12

Mar

2020

Mar

2020

Israeli and local investors drive Romania’s market

A new peak in total transaction volumes of €13.9 billion was reached last year across the CEE region. Including Austria and Serbia, the volume is even greater: €20.19 billion, according to CBRE’s latest research.

Read more >

11

Mar

2020

Mar

2020

Arete launches €500 million CEE logistics fund

The Arete investment and real estate group announced the opening of its third qualified investor fund, based in the Czech Republic and operating under the supervision of the Czech National Bank. This third fund is to follow on from the successful history of the preceding funds, with the first fund having been closed three years ago and investors paid off with a total gross appreciation of 120%, while the second fund has fulfilled its strategy with its current gross appreciation of over 90%. The new Arete fund will both invest into completed industrial real estate in Central and Eastern Europe and also itself construct new logistics and manufacturing buildings. Its portfolio target value should approach €500 million during the anticipated six-year investment cycle.

Read more >

10

Mar

2020

Mar

2020

Investor appetite for CEE markets remains strong for 2020

Poland is a major target for international capital with investment volumes in 2019 accounting for 55% of the CEE6 total. The Czech Republic followed with a 24% share and Hungary with 13%. Elsewhere in the region, volumes fell short of 2018 & 2017 volumes. Despite record low yields in most markets and sectors, some further yield compression is anticipated over the next 12 months as strong levels of capital seek product and returns. Colliers International published its investment market summary for 2019.

Read more >

04

Mar

2020

Mar

2020

Poland offers huge potential for risk-taking investors

Demand for alternative residential investments, mainly student housing and residential-for-rent, is clearly growing in Central & Eastern Europe with countries like Poland offering great opportunities for developers. More than 130 real estate professionals came together at the first-ever Alternative Investment Forum, organized by CEE event and intelligence hub Property Forum, in Warsaw.

Read more >

03

Mar

2020

Mar

2020

Prologis appoints new Regional Head for Central Europe

Prologis has appointed Paweł Sapek as Regional Head Central Europe, a role in which he is responsible for maintaining strong team leadership, identifying new opportunities and steering the region towards new paths of development. Sapek is now responsible for overseeing the company's entire CE portfolio across Poland, the Czech Republic, Slovakia and Hungary, with a total area of 4.2 million square meters. In addition, he will run the Polish branch of Prologis and directly supervise operations in Hungary.

Read more >

02

Mar

2020

Mar

2020

Garbe Industrial Real Estate expands into CEE

Garbe Industrial Real Estate GmbH, one of the leading specialists for logistics and industrial properties in Germany and other countries in Europe, is expanding its footprint in Central Eastern Europe. Martin Polák, a former managing director at Prologis, will join Garbe as Managing Director CEE and will be in charge of the further expansion in the region.

Read more >

02

Mar

2020

Mar

2020

Carpinus Holding buys into Immofinanz

Carpinus Holding GmbH has acquired a total of 12,000,000 shares in Immofinanz, corresponding to a shareholding of approximately 10.71%. The indirect shareholders of Carpinus Holding GmbH are Peter Korbacka and RPR Privatstiftung (Ronny Pecik).

Read more >

Latest news

- Capturing yield in CEE: Gránit AM’s playbook for the next market cycle

- Accor to open new Mercure hotel in Craiova

- Świecie unveils masterplan for Teutonic Castle revival

- Big Poland acquires retail park in Dzierżoniów

- Star Invest launches €12 million capital raise for office deal in Bucharest

- LCN exits Croatian Konzum grocery store portfolio

- Why are Baltic investors increasingly looking at Poland?

- B+N Group rebrands as Liwo Group for European expansion

- P3 Poznań Park secures over 60,000 sqm in lease renewals

- IGD sells building in Turda to municipality

New leases

- REHAU, a global manufacturer of advanced polymer solutions, has signed a lease for approximately 4,100 sqm of space at MLP Business Park Poznań. The new facility will integrate warehouse operations with modern office space and a dedicated showroom for product presentations, corporate meetings, and technical training.

- RecuNova has leased 305 sqm in the Bucharest-based Olympia Tower office building for a new medical clinic. The lease deal was brokered by Activ Property Services.

- Gaya Studios has 190 sqm in Green Gate office complex, in a deal brokered by Rustler Romania.

New appointments

- Krzysztof Wróblewski (MRICS) has been named Head of Portfolio Management CEE at Peakside Capital Advisors, responsible for overseeing investments and managing the real estate portfolio. He succeeds Christopher Smith in this role.

- Garbe Industrial is reorganising its senior leadership team. CEO Christopher Garbe will now focus on strategic orientation and international activities. Jan Philipp Daun assumes leadership of the Development division alongside his existing Investment and Joint Venture responsibilities. Andrea Agrusow expands her remit to include Portfolio Management while retaining control of Commercial and Real Estate Management. Additionally, Michael Marcinek and Maik Zeranski will now jointly head the restructured Development unit as Management Board Members, succeeding Adrian Zellner.

- CPI Property Group is strengthening its leasing structure with the appointment of Agnieszka Baczyńska as Head of Leasing. In her new role, she will be responsible for shaping and executing the leasing strategy across the group’s office and retail portfolio in Poland. At the same time, Izabela Potrykus has been appointed Leasing Office Director. Baczyńska brings more than 20 years of experience in the commercial real estate market. Prior to joining CPI Property Group in 2022, she served as International Leasing Director at Neinver Polska.