In line with Goodman's strategy to focus its portfolio on gateway cities and major urban consumer markets in Continental Europe, the Goodman European Partnership and Goodman Group have signed an agreement for the sale of assets in Central and Eastern Europe for approximately €1 billion to global investment manager GLP. The transaction, which is subject to regulatory approval, includes properties located in Poland, Hungary, Czech Republic and Slovakia.

Philippe Van der Beken, Chief Executive Officer Goodman Continental Europe said: “The proceeds of this transaction will enable us to capitalise on the strong demand for industrial property and continue to scale up in the major consumer markets in Germany, France, Spain, Benelux and Italy. We will continue to focus on owning high-quality properties and building out our significant development pipeline in these markets, where barriers to entry are high and land is scarce.”

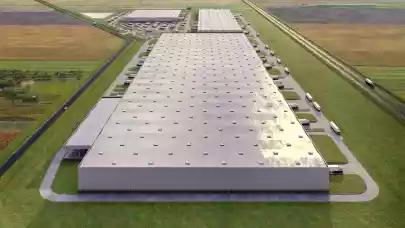

GLP entered the European market in December 2017 through the acquisition of Gazeley, a developer, investor and manager of European logistics warehouses and distribution parks with a 2.4 million sqm portfolio across the UK, Germany, France, Spain, Italy, Poland and the Netherlands. The addition of this unique, high-quality portfolio that is spread across Poland, Czech Republic, Slovakia and Hungary will expand GLP’s European presence to 10 countries and it will join a select number of logistics real estate investors with a truly pan-European portfolio.

The acquired 2.4 million sqm portfolio is concentrated on key logistics routes across the region with access to growing markets for e-commerce and distribution. It will bring a number of new customers into the business and allow it to better support existing customers with their expanding supply chain requirements across Europe in Poland, Czech Republic, Slovakia and Hungary.

In addition, Goodman Group’s Central and Eastern European approximately 40-person team working in the region will join GLP’s European team, Gazeley, upon completion of the transaction and will support the Company’s growth across Europe.

The acquisition of the portfolio follows a broader European expansion since GLP entered the market at the end of 2017. In the past year, it has opened offices in both Spain and Italy following a number of development opportunities.

Nick Cook, Chief Executive Officer, Gazeley, said: "This deal is a very exciting part of our European growth strategy. The scale and geographic footprint of the portfolio are highly complementary to our existing business and offer us compelling opportunities for growth in a number of important European markets. We are confident that the addition of this portfolio will support us in delivering further value to investors and our customers. We very much look forward to welcoming the team, its customers and partners to Gazeley in the coming months.”

Kirkland & Ellis served as legal counsel to GLP, with Greenberg Traurig and Kinstellar providing local legal advice. Cushman & Wakefield served as advisors to GLP and Goldman Sachs and Citi have committed to financing the acquisition.