The Romanian retail market continued to expand in 2016 with total stock reaching 1.22 million sqm in Bucharest and 2.3 million sqm in regional cities. For 2017 no major retail project is scheduled for completion in the capital, while 130,000 sqm are expected to be delivered in regional cities. DTZ Echinox Romania published its retail reports for 2016.

No new openings planned for Bucharest

The modern retail stock in Bucharest reached 1.22 million sqm at the end of 2016 and most comprises shopping centres (56%) and retail parks (33%), while commercial galleries cover the remaining 11%. Last year new supply reached 98,500 sqm, after the openings of Parklake Plaza and Veranda Shopping Center and the extension of Militari Shopping retail park.

For 2017 no major retail project is scheduled for completion. The current pipeline is limited and consists of the extension of retail schemes such as AFI Palace Cotroceni and Promenada Mall. Starting 2018, however, the situation is likely to change, since currently in the northern part of the city some projects are in early stages of development.

Regional retail markets continue to grow

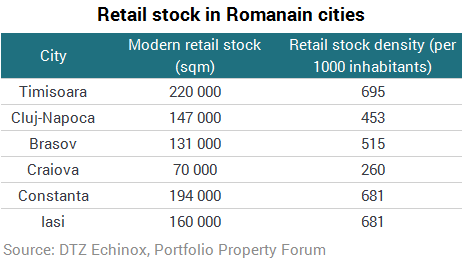

At the end of 2016, the modern retail stock outside Bucharest reached 2.3 million sqm. Shopping centres account for app. 60%, while retail parks and commercial galleries represent 34% and 7%, respectively, from the total retail stock. A total of 140,000 sqm of modern retail spaces were delivered throughout 2016, divided between several projects.

The largest project delivered was Shopping City Timisoara – phase II, with a total GLA of 41,000 sqm, followed by Shopping City Piatra Neamt, with 28,000 sqm GLA and Mercur Craiova, project with a rentable area of 15,000 sqm. Additionally, City Park Mall in Constanta and Coresi Shopping Resort in Brasov were extended with 21,000 sqm and 14,000 sqm.

Headline rents achieved for units of 100 sqm in prime shopping centers outside Bucharest range on average between € 22 – 27 per sqm/month. In primary cities such as Cluj Napoca, Timisoara, Iasi or Constanta the prime headline rents are higher by 20% - 30%. For tertiary cities the prime headline rents are between € 15 – 20 per sqm/month.