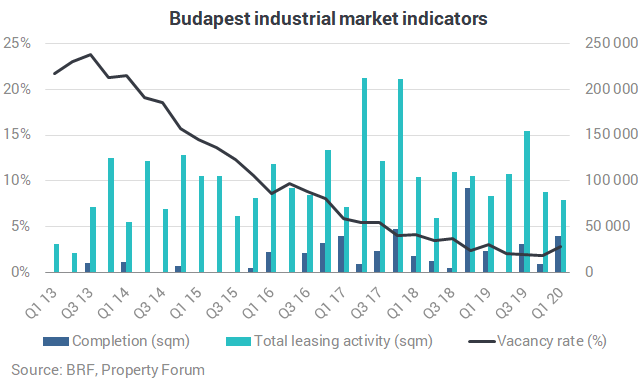

Total demand on the Budapest industrial market amounted to 79,660 sqm in Q1 2020, indicating a 5% decrease from the figure noted in the same period last year. Lease renewals accounted for an outstandingly high ratio, reaching 85% of the quarterly volume. The Budapest Research Forum published its quarterly industrial market analysis

In Q1 2020, 40,010 sqm of new space was added to the total modern industrial stock in Budapest and its surroundings, as the BUD Cargo City (8,700 sqm) and the new building of CTPark West (31,320 sqm) were handed over.

The total modern industrial stock in Budapest and its surroundings stood at 2,286,970 sqm at the end of Q1 2020.

Total demand amounted to 79,660 sqm in Q1 2020, indicating a 5% decrease from the figure noted in the same period last year and a 10% decrease compared to the previous quarter. Lease renewals accounted for an outstandingly high ratio, reaching 85% of the quarterly volume, followed by new leases with a share of 10%. Pre-lease stood for 5% and expansions stood for 0.2% of the quarterly figure. Take up excluding renewals added up to 11,840 sqm which was 13% lower than in Q1 2019.

19 leasing transactions were recorded in the first quarter of 2020, out of which three agreements were signed for more than 10,000 sqm. The average transaction size was 4,190 sqm during the quarter. 96% of the transaction volumes were recorded in logistics parks, with an average transaction size of 5,470 sqm. The remaining 4% of the transactional volume was registered in city logistics parks, reaching an average transaction size of 630 sqm which consists of an average transaction size of 1,000 sqm in case of warehouse space and an average transaction size of 235 sqm in case of office space.

The two largest transactions in Q1 were renewals in a building of Batta Park on 28,590 sqm and the other was in Prologis Park Budapest M1 on 15,880 sqm.

The vacancy rate at the end of Q1 2020 stood at 2.8% resulting in a 0.97%-point decline q-o-q, and a 0.28%-point decrease y-o-y. At the end of the first quarter, a total of 63,830 sqm logistics area stood vacant, and there is only one existing warehouse with available space of more than 5,000 sqm.

Net absorption totalled 17,830 sqm in the first quarter of 2020.