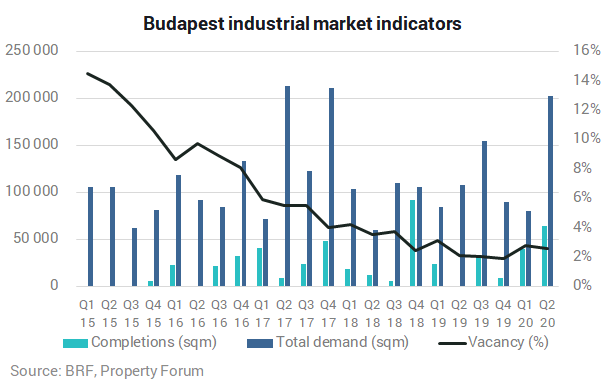

Total demand on the Budapest industrial market amounted to 202,610 sqm in Q2 2020, which is two times higher than the figure registered in the same period last year and 17% higher than the 4-year average Q2 volume. The Budapest Research Forum published its quarterly industrial market analysis

In Q2 2020, 64,140 sqm of new space was added to the total modern industrial stock in Budapest and its surroundings, as the newest phase of East Gate Business Park (17,780 sqm), the new building of CTPark South (22,840 sqm), the Prologis Harbor DC11 building (13,520 sqm) and the newest phase of Budapest Dock Szabadkikötő (10,000 sqm) were handed over. The total modern industrial stock in Budapest and its surroundings stood at 2,351,110 sqm at the end of Q2 2020.

Total demand amounted to 202,610 sqm in Q2 2020, which is two times higher than the figure registered in the same period last year and 17% higher than the 4-year average Q2 volume. New leases accounted for 45.6% of the quarterly volume, followed by renewals with a share of 29.2%. Pre-lease stood for 19.6% and expansions for 5.6% of the quarterly figure. Take up excluding renewals added up to 143,350 sqm.

22 leasing transactions were recorded in the second quarter of 2020, out of which 8 agreements were signed for more than 10,000 sqm. The average transaction size was 9,210 sqm during the quarter. 95% of the transaction volumes was recorded in logistics parks, with an average transaction size of 11,890 sqm. The remaining 5% of the transactional volume was registered in city logistics parks, reaching an average transaction size of 2,060 sqm. 14% of city logistics take-up compiled of renewals, while 86% stood for expansions.

The two largest transactions in Q2 were a renewal in Batta Park on 28,585 sqm and a pre-lease in CTPark Budapest South on 28,460 sqm.

The vacancy rate at the end of Q2 2020 stood at 2.59% resulting in a 0.22%-point decline q-o-q, and a 0.45%-point incline y-o-y. At the end of the second quarter a total of 60,930 sqm logistics area stood vacant, and there is only one existing warehouse with available space of more than 5,000 sqm.

Net absorption amounted to 67,030 sqm in the second quarter of 2020.

The Budapest Research Forum (BRF) comprises CBRE, Colliers International, Cushman & Wakefield, Eston International, JLL and Robertson Hungary.