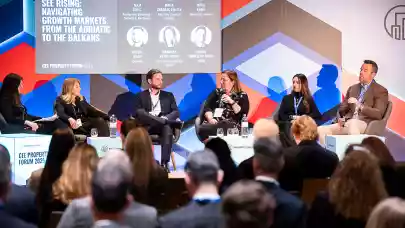

At CEE Property Forum 2025, the conversation around Southeast Europe shifted decisively from potential to performance. Chaired by Maja Šubic, Partner at Andersen Slovenia | Senica & Partners, the panel brought together investors, bankers and advisors to examine why capital is flowing more confidently into the Balkans and Adriatic markets — and what separates sustainable opportunities from short-term plays. Rather than broad optimism, the discussion focused on concrete drivers such as sector-specific demand, evolving financing structures and the growing importance of local partnerships in unlocking long-term value across the region.

Providing a broad regional perspective was Boško Tomašević, Managing Director SEE at CBRE. He detailed both the promise and complexity of the Balkans property market in 2025. “The Balkans are a never-ending story for investors—with 2025 shaping up to be a solid year. We project investment volumes to reach around €900 million, making it a standout period for the region, with every asset class showing growth, especially in hotspots like Slovenia for offices and Croatia for industrial pipelines,” commented Tomašević. “Slovenia stands out as the hottest market for office investments, Croatia for its industrial sector with the lowest vacancy rate, and Serbia is seeing a resurgence in retail, while Bulgaria leads in office investment potential.”

The discussion soon moved from regional data to specific market shifts, with Gabriela Reyes Vidrio, Head of Real Estate Project Finance at NLB Komercijalna banka, outlining the evolving investor landscape in Serbia. “Most real estate investors in Serbia are now non-EU, with significant capital flows from Israel, the UAE, and South Africa,” she revealed. “We’re seeing not only shifts in investor origin but also in loan structures, with up to 70% loan-to-cost ratios, longer loan terms exceeding ten years, and a growing comfort level among investors and banks as the market matures.”

Mirta Ceranac Poljak, Managing Director at Martley Capital Croatia, brought forward the necessity of creativity and adaptability to thrive in the region. “We see real opportunity not just by following trends, but by digging deeper to create investment prospects that aren’t immediately apparent. True success comes from building partnerships with local companies and managing assets with a long-term commitment, because in these markets, the best projects are not simply handed to you by agents, but discovered and developed collaboratively,” she emphasised.

Turning attention to Slovenia, Dóra Kenéz, Managing Director at Mendota Invest, detailed the transformative Emonika mixed-use project in Ljubljana. “Entering the Slovenian market, particularly with the Emonika project, signified more than a decade-long commitment for us,” Kenéz shared. “We learned that flexibility is key—our original design changed twice, allowing us to respond to shifts in market demand, especially the surprising surge of interest in hospitality and residential units. Today, more than half of the residential units are sold, and office space is quickly being absorbed, showing the robustness of demand.”

Michal Maco, Country Manager Slovenia at Corwin, added firsthand experience on capitalising on Ljubljana’s rise. “Ljubljana, with its high quality of life and stable business environment, has become our company’s largest market, and there’s still major untapped potential,” Maco highlighted. “Our Vilharia project, now 85% pre-leased, wouldn’t have been possible without the determined support of both Slovene partners and banks, whose trust in the market continues to grow as demand for modern, ESG-compliant office spaces outpaces supply.”

Concluding, the panel emphasised that while Southeast Europe remains a market of high yield and opportunity, it is the willingness to adapt, partner locally, and look beyond surface trends that distinguishes successful investors.