KGAL has acquired the DRN office building in Prague for a pan-European special real estate Alternative Investment Fund (AIF). The purchase is in line with KGAL’s strategy of Europe-wide diversification across prime locations, and is its first investment in the Czech Republic. The fund now holds properties in Germany, Austria, Ireland, Hungary, the Netherlands, Poland and the Czech Republic.

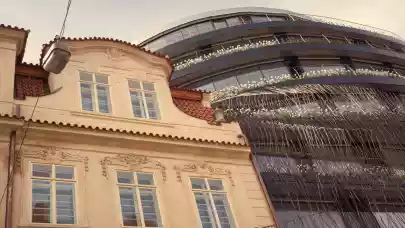

The centrally located property features contemporary space and a heritage building. Designed by Stanislav Fiala, the building incorporates parts of the original Schönkirchovský Palace which dates from 1734 with an interconnecting new building which was completed last year provides high-quality office space and eating and drinking amenities.

DRN is located in the centre of Prague and is close to the National Theatre, Charles Bridge and Wenceslas Square. The central metro station Národní třída is 300 metres away. The property is almost fully let and is currently home to 13 occupiers. The rentable space totals 12,595 sqm with 2,290 sqm in the old building and 10,305 sqm in the new building.

The Czech Republic is an increasingly attractive location for commercial real estate investors. Since 2011, the country has held an AA- rating from the rating agency Standard & Poor’s – the best rating in Central and Eastern Europe. The KGAL real estate team expects trophy properties such as DRN to lead the way at the top end of the market in the long term.

DRN will be incorporated into an international real estate AIF run by KGAL. The fund now holds real estate in six European capital cities: Berlin, Budapest, Dublin, Prague, Warsaw and Vienna. The property was acquired from the developer SEBRE. White & Case, TPA, Arcadis and CBRE acted for KGAL in the acquisition. Savills advised SEBRE.