ARTICLES LABELLED WITH TAG retail

29

Nov

2022

Nov

2022

Regional cities can help make Romania the next Poland

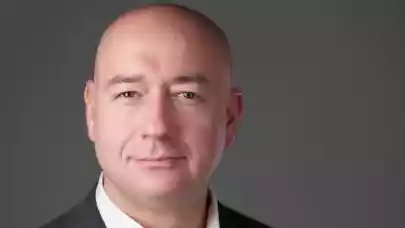

Marius Persenea, COO of Romanian developer Iulius, spoke with Property Forum about the macroeconomic picture of the country going into 2023 and the potential of regional cities to attract property investments on the medium and long term.

Read more >

24

Nov

2022

Nov

2022

Kaufland reaches 1,500 hypermarkets in Europe

Grocery retailer Kaufland has inaugurated in Bucharest a new hypermarket spanning 5,000 sqm. Following the latest opening, the European network of the retailer climbed to 1,500 units.

Read more >

24

Nov

2022

Nov

2022

Bucharest moves up in most expensive shopping street ranking

With a rent level of €53/sqm/month on Calea Victoriei, the main retail street of the city, Bucharest remains in the top 50 cities analyzed worldwide and in position 46 out of 53 in the EMEA ranking, just behind Warsaw, according to a report by real estate consultancy Cushman & Wakefield Echinox.

Read more >

24

Nov

2022

Nov

2022

Indotek Group starts revamp of Târgu Mureș shopping centre

Hungarian property investor Indotek Group is extending its facelift program to its international retail portfolio, with the renewal of the nearly 50,000 sqm Promenada Mall in Romania. The company is carrying out the modernization of the shopping centre in Târgu Mureș in two phases.

Read more >

22

Nov

2022

Nov

2022

Are outlet centres resilient to the current economic slowdown?

Consumer behaviour is changing and shoppertainment is a big opportunity to continue to generate engagement and drive loyalty. Outlet centres can offer a wide range of branded goods and a variety of excitement for the whole family in our turbulent times, Csaba Imre, Country Manager of ROS Retail Outlet Shopping, the operator of Premier Outlet Centre in Biatorbágy, Hungary explains in our latest interview.

Read more >

16

Nov

2022

Nov

2022

NEPI Rockcastle buys Atrium Copernicus centre in Toruń

NEPI Rockcastle has entered into an agreement to acquire 100% of the shares in Atrium Copernicus, the entity that owns Atrium Copernicus Shopping Center in Toruń, Poland, from Atrium Retail Ltd.

Read more >

16

Nov

2022

Nov

2022

Forty Management sells commercial spaces in Bucharest

Romanian developer Forty Management has sold commercial spaces covering 1,200 sqm in three Bucharest-based projects for €3.3 million, excluding VAT.

Read more >

16

Nov

2022

Nov

2022

Service providers adjust services to rapidly changing demand

Service providers, including international property agencies, are bound to adjust their services to the rapidly changing demand from occupiers, developers and investors. Property Forum asked Kata Mazsaroff, the recently appointed Managing Director of Colliers Hungary to unveil her expectations about the commercial real estate market in the region and in Hungary in particular.

Read more >

14

Nov

2022

Nov

2022

Income-producing properties in Romania see growing investments

Income-producing properties are becoming an increasingly appreciated option for Romanian or foreign private investors who have previously been mainly active in the residential sector, according to real estate consultancy Cushman & Wakefield Echinox.

Read more >

11

Nov

2022

Nov

2022

The race is on to develop more retail parks in Croatia

Immofinanz leads the development of retail parks across Croatia, with plans for surpassing Supernova and becoming the market leader in Croatia, while local developers remain active as well, focusing on undersupplied locations and the outskirts of large cities.

Read more >

Latest news

- Bucharest's unoccupied homes stock more than doubles in decade

- Ljubljana’s largest-ever development enters strong leasing phase

- Realia fund acquires 14,000 sqm Czech retail park

- Czech industrial real estate hits record construction levels in 2025

- GTC leases nearly 32,000 sqm in Polish shopping centres

- Romania's construction volume close to new record in 2025

- Hushoffice expands in Łódź with 13,000 sqm across two Panattoni sites

- 7R sells warehouse to French investor entering Poland

- Speedwell completes 128 apartments in northern Bucharest

- Romania's retail stock second largest in CEE despite low density

New leases

- The EYEmova ophthalmology and training center has joined the tenant roster at Soho by Yareal in Warsaw’s Kamionek district, occupying over 500 sqm. The opening of the EYEmova center in Praga-Południe is scheduled for June this year.

- RPHI Romania secured approximately 9,000 sqm of premium lease agreements in 2025 at Bucharest-based SkyTower. The transactions comprised both new tenancies and expansions from existing occupiers. The tower attracted six new tenants across diverse sectors, including food delivery, insurance management, and cybersecurity.

- EPP's Galeria Sudecka in Jelenia Góra is strengthening its offering with lifestyle and service brands, including a newly opened Fit Style gym, the addition of Rituals Cosmetics and Kodano Optyk, and the expansion of Medicine and Wakacje.pl. The new agreements and renewals in Galeria Sudecka cover almost 1,900 sqm of commercial space.

New appointments

- Garbe Industrial is reorganising its senior leadership team. CEO Christopher Garbe will now focus on strategic orientation and international activities. Jan Philipp Daun assumes leadership of the Development division alongside his existing Investment and Joint Venture responsibilities. Andrea Agrusow expands her remit to include Portfolio Management while retaining control of Commercial and Real Estate Management. Additionally, Michael Marcinek and Maik Zeranski will now jointly head the restructured Development unit as Management Board Members, succeeding Adrian Zellner.

- CPI Property Group is strengthening its leasing structure with the appointment of Agnieszka Baczyńska as Head of Leasing. In her new role, she will be responsible for shaping and executing the leasing strategy across the group’s office and retail portfolio in Poland. At the same time, Izabela Potrykus has been appointed Leasing Office Director. Baczyńska brings more than 20 years of experience in the commercial real estate market. Prior to joining CPI Property Group in 2022, she served as International Leasing Director at Neinver Polska.

- Axi Immo has expanded its Office Agency team to strengthen its presence in southern Poland and Warsaw. Karolina Słysz joins as Head of Regional Markets, bringing 10 years of experience to lead efforts in Katowice, Kraków, and Wrocław. Elżbieta Golik has been appointed Associate Director, leveraging over eight years of expertise in tenant representation. In Warsaw, Filip Kowalski joins as Associate Director, focusing on lease negotiations. Additionally, Anna Piłka-Sutkowska has been promoted to Advisor following four years with the firm. To support these transitions, Natalia Majsterek has been hired as Office Department Coordinator.