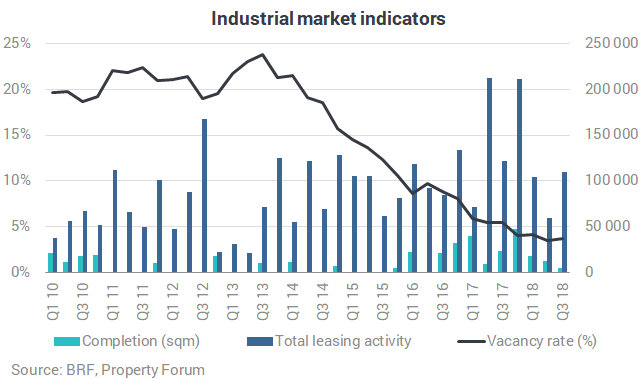

The vacancy rate slightly increased on the Budapest industrial market to 3.7%. At the end of the Q3 2018 a total of 76,240 sqm stood vacant, and there are only two existing schemes with more than 5,000 sqm of available warehouse space. The Budapest Research Forum published its quarterly industrial market analysis

In the third quarter of 2018, one new building was handed over, a 5,000 sqm warehouse in the next phase of Budapest Dock Szabadkikötő.

The total modern industrial stock in Budapest and its surroundings stood at 2,086,120 sqm at the end of Q3 2018.

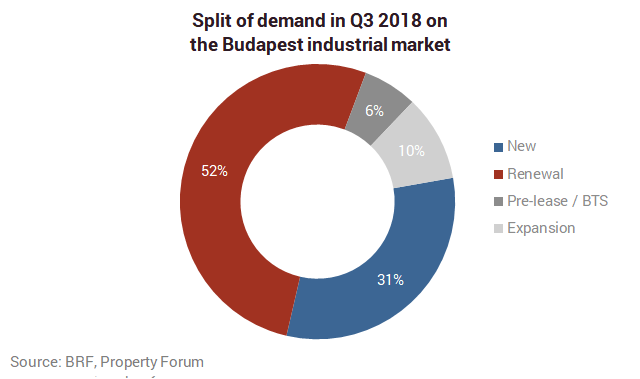

Total demand amounted to 109,350 sqm in Q3 2018, marking a 10% decrease from the figure noted in the same period last year but 83% increase compared to the previous quarter. Lease renewals accounted for 52.1% of the quarterly volume, while the share of new leases was 31.4%. Expansions stood for 10.1% of the quarterly volume. One pre-lease agreement was signed in the third quarter, representing 6.4% of total demand.

27 leasing transactions were recorded in the third quarter, out of which two agreements were signed for more than 10,000 sqm. The average transaction size was 4,050 sqm during the quarter. All leasing activity was recorded in logistics parks, as during this quarter BRF did not register any city logistics transactions.

The two largest transactions of the quarter were a lease renewal in the existing building of CTPark West on 17,500 sqm and in the building of CTPark East on 12,000 sqm. The largest expansion deal was in one of the logistics warehouses of BILK on 7,720 sqm. The largest new lease agreement amounted to 6,630 sqm, which was signed in CTPark East.

The vacancy rate slightly increased by 0.2 pps q-o-q, to the current 3.7%. At the end of the third quarter, a total of 76,240 sqm stood vacant, and there are only two existing schemes with more than 5,000 sqm of available warehouse space.

Net absorption totalled 2,490 sqm in the third quarter of 2018.

The Budapest Research Forum (BRF) comprises CBRE, Colliers International, Cushman & Wakefield, Eston International, JLL and Robertson Hungary.