The hotel market in Bucharest is widely dominated by 4* and 5* hotels, categories which represent 70% of the total capacity, while at the opposite - 1* and 2* hotels – cover only 10%. Bucharest is the most developed market for hotels in Romania, with 47% of the total number of hotel rooms being affiliated to international chains, compared to a national average of 7.5%. In fact, 66% of the hotel rooms in Romania that are affiliated with international brands can be found in Bucharest.

During the next three years, the hotel capacity in Bucharest is expected to increase by at least 10%, considering the fact that at least seven hotels with approximately 1,000 rooms (and a total capacity of +2,000 people) are currently planned, under construction or undergoing a complete refurbishment.

Bucharest (46.6%), Sibiu (37.6%), Oradea (27.3%) and Cluj-Napoca (18.9%) have the largest proportion of rooms affiliated to international hotel chains, while Constanta (5.4%), Timisoara (4.4%) and Brasov (3.4%) stand at the opposite, being positioned below the country average (7.6%).

Hotels in Iasi (45.6%), Bucharest (44.7%) and Cluj-Napoca (44.6%) achieved the largest net occupancy rates in 2017, calculated as a proportion of occupied beds; Cluj-Napoca (+24.2%), Oradea (19.8%) and Brasov (11.3%) reported the largest increase in hotel arrivals, compared to previous year.

The hospitality investment market in Romania was amongst the most active in the CEE in 2017, with two properties being transacted (Radisson Blu complex in Bucharest and Vienna House Easy Airport Bucharest - former Angelo Otopeni) with a cumulated value of €183 million. The prime yield for Bucharest hotels is app. 7.5% and the investment activity in the hospitality sector is expected to continue, expanding also across secondary cities.

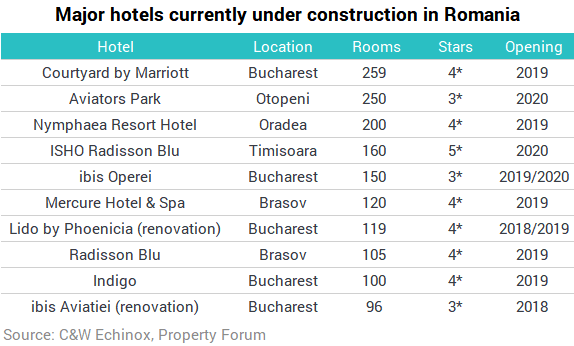

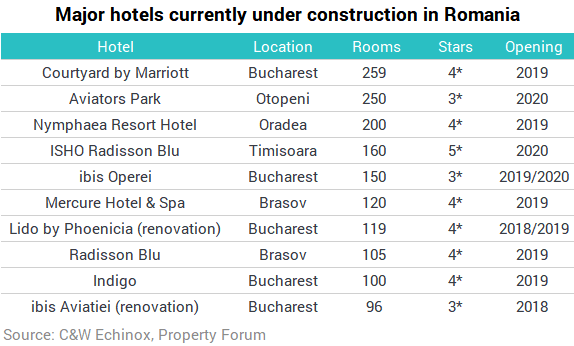

The new hotel pipeline is consistent both in Bucharest and in the regional cities. Most of the developers seek to be part of the international chains, thus C&W Echinox expects the share of the branded hotel rooms will increase in the following years.

The planned and under construction hotels target the business community, as it is the case of Courtyard by Marriott developed on Dimitrie Pompeiu Bd. in Bucharest or ISHO Radisson Blu in the mixed-use project ISHO Timisoara, or the leisure tourists (Nymphaea Resort Hotel Oradea or Mercure Hotel & Spa Brasov), while Aviators Park is mostly a transit location, as its future location is situated right across Henri Coanda International Airport from Otopeni – Bucharest, the largest airport in Romania. Most of the new hotels are classified at 3* and 4*, while Radisson Blu will operate the first 5* hotel in Timisoara starting with 2020.

The hotel market in Romania has been on a positive trend since 2010, with an increasing number of tourist arrivals and overnight stays. Moreover, due to the fact that there has been a limited new supply of hotels in most of the major Romanian cities, the existing ones have been able to improve occupancy rates and increase the average daily rates.

Romanians travel more abroad (19.9 million departures in 2017, a 24% increase compared to 2016), but also within the country, due to an increasing purchasing power. Romanians represent 77.2% of the total number of tourists in the country, but during the last decade the interest of the foreign tourists in visiting Romania also saw a considerable increase; since 2009, the number of foreign tourists accommodated by the Romanian hospitality industry more than doubled, reaching 2.75 million people in 2017 (compared to 1.27 million in 2009). The major attractions for foreigners were Bucharest (1.2 million tourists in 2017), the most important business hub in Romania and a more and more popular city-break destination, followed by Brasov, Sibiu, Timisoara and Cluj.

The positive evolution of this industry has been sustained by the air transportation, with low-cost companies being the fundamental reason for doubling the total air traffic in Romania during the last decade, to 20.3 million passengers in 2017. This sector is expected to maintain a double-digit growth during the following years, thus increasing the demand for local accommodation facilities.