The total stock of purpose-built student accommodation (PBSA) in Prague exceeds 28,400 beds. 91% of these capacities are in the ownership of universities and the remaining 9% is provided by the private sector, according to the latest Savills “Student Housing in Prague” report.

“Although the overall capacity of university-owned PBSA stock is likely to decline slightly in the coming years, the number of privately owned residences is on the rise. In October 2019, we recorded 11 larger private residences, with a capacity of 35+ beds each, offering accommodation to students in Prague while in March 2021 there were 14. Together with a number of smaller properties, the total number of beds provided within private facilities rose to around 2,580,“ says Lenka Pechová, Senior Research Analyst at Savills CZ&SK.

Currently, the largest operator of private student accommodation in Prague is International Campus with 675 beds in its only residence – THE FIZZ Prague, in the Prague 7 - Holešovice area, followed by Zeitgeist Asset Management with a total of 420 beds located across its four residences located in Prague 3, Prague 7 and Prague 10. There are no larger PBSA projects under construction in Prague these days, although several new student residences are planned across the city. These include new developments as well as conversions and refurbishments of older buildings.

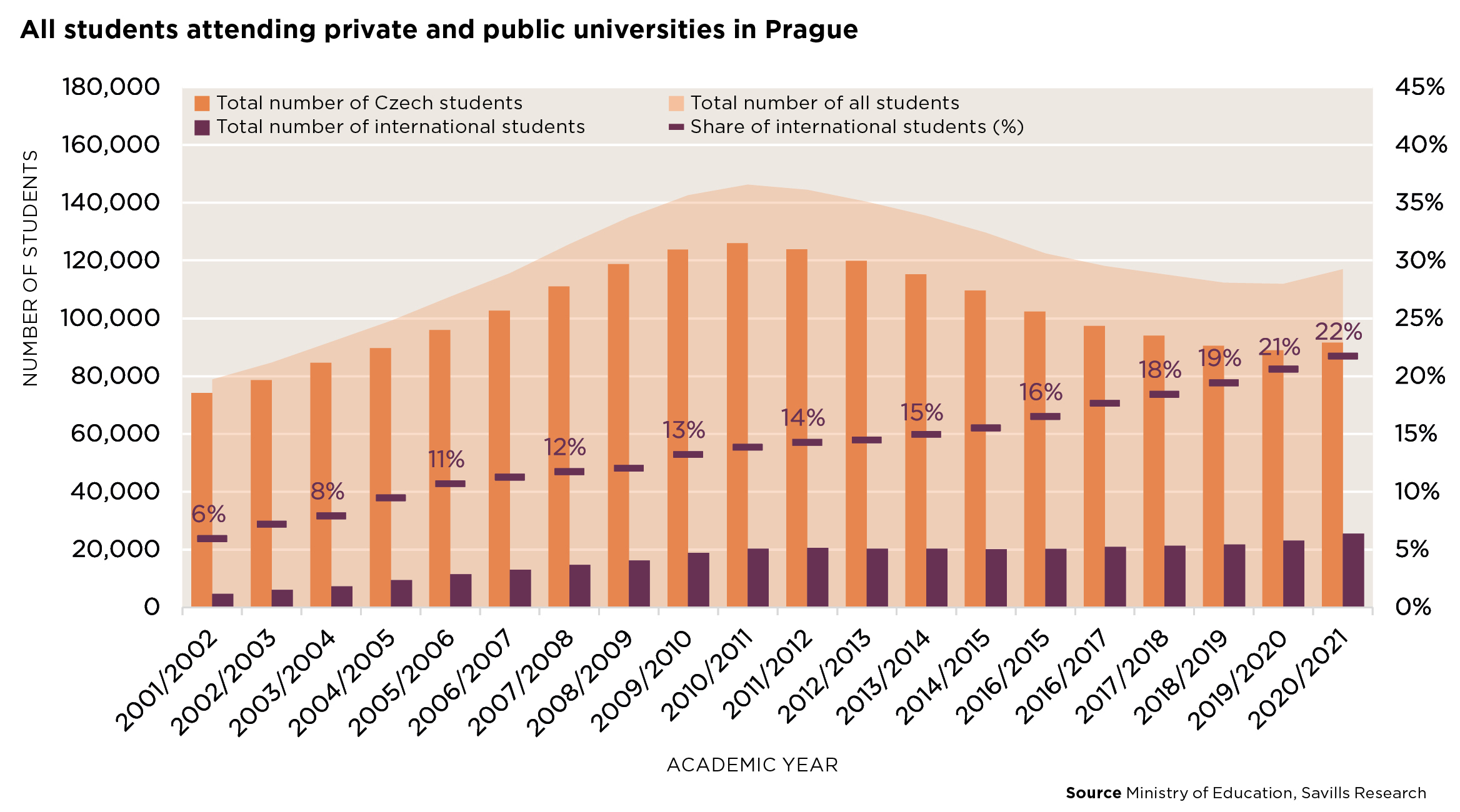

According to Savills survey among operators of private PBSA in Prague, their core tenant base is mostly made up of international students. The community of foreign students studying in Prague has been growing every year in the last five years. In the current academic year, this group expanded by 10% y-o-y (i.e. 2,354), being the highest growth rate recorded since 2010.

The shift to remote learning and measures restricting accommodation of students at dormitories, which were put in place to prevent the spread of the coronavirus, obviously caused significant occupancy decline at public and private student residences. However, this effect is only temporary and a return to the standard student life at universities and student residences is expected to occur in the academic year of 2021/2022.

In the report, “Student Housing in Prague”, the international real estate advisor says that the purpose-built student accommodation is a pioneer real estate segment, which is demonstrating how a niche specialist and opportunistic product can come to be part of the mainstream. Despite the overall market disruption brought by the COVID-19 pandemic, according to RCA, the European student housing market attracted investment in a total volume of €8.5 billion in 2020 and €9.3 billion in 2019. Excluding the UK, which is the most mature market in Europe for student housing, transactions across mainland Europe exceeded €3 billion in 2020, as well as in 2019.

“In the European context, the Czech Republic is among the emerging PBSA markets. The investment activity within this real estate sector has been very scarce and the low availability of existing prime student accommodation assets on the market does not provide relevant transaction evidence, however, based on the increasing level of investor’s interest, as well as the level of prime residential yields, we would estimate prime yields for high-quality student residences in Prague to be at the level of 4.25%,” comments Fraser Watson, Director - Investment Advisory at Savills CZ&SK.