Interest in investments in the private student housing sector in Poland is constantly growing. Investors see this market as highly absorptive, which currently satisfies less than 10% of the demand for student accommodation. Significant advantages include forecasts concerning the constantly growing number of foreign students in Poland and attractive rates of return on investment, according to a new report prepared by ThinkCo in cooperation with Golub GetHouse.

To learn more about this asset class, join our upcoming online panel on residential investments.

Over the past four years, international capital investment in student accommodation has accounted for about 40% of investment in the European real estate market. In the context of relatively low investment costs, the market of private student houses (“PBSA” – Purpose Built Student Accommodation) is a safe alternative to the office and retail sectors, taking into consideration the fact that returns on investment in student houses in Western markets have been stable at 4.5-6% for several years now. This is the reason why existing operators are planning to expand their investments into new markets and create new international brands. This means that the level of active capital will continue to increase globally.

Poland is becoming an attractive market for investing in private halls of residence for a number of reasons. Investors point to higher returns on investment than in Western Europe (up to 7%), as well as high market absorption and shortage of accommodation in currently available student houses (supply of about 10%). Other factors contributing to the development of this sector include a large population of students (1.29 million) and a constantly growing number of foreigners coming to study in Poland. Currently, there are almost 73,000 foreigners studying in Poland, and since 2011, Polish universities have seen the number of young people from abroad increase by about 8,000-10,000 year to year. Moreover, the OECD predicts that the number of students studying abroad will increase from 5 million in 2019 to 25 million in 2025.

Tomasz Bojęć, Managing Partner in ThinkCo, said: ‘Good conditions for studying, the possibility of free education, development of student exchange programmes and wide access to cultural and gastronomic offer combined with relatively low prices of living – these are just a few of the factors influencing the growth of interest in Poland among young people from abroad. As their most frequent choice in terms of accommodation is a student house, this group of students is becoming a major recipient of the PBSA market and has a tremendous impact on the development of this industry in Poland.’

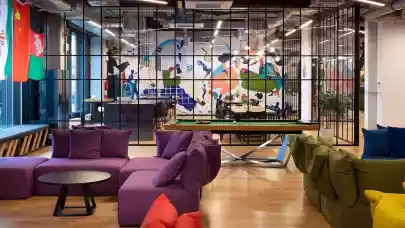

PBSA is the first real estate sector whose offer is addressed to the ‘Generation Z’, now entering adulthood. Members of this generation are observed to treat issues such as ownership, security and capital quite differently than the Millennials. While choosing a place to live when going to university, the new generation is guided primarily by the value for money ratio. This does not mean looking for the lowest possible price, but feeling that the money is spent effectively.

Representatives of this generation state that they are willing to pay more for access to certain facilities. These include, among others, high-speed internet, a larger room, a gym or 24-hour security. As many as 76% of them emphasise the importance of high-quality common areas in the student house, and 81% – the need to belong to organised interest groups and circles.

Currently, in Poland, there are a total of 127,384 beds available for students in student houses, of which only 6,592 beds are in private investments. By 2023, this number will have increased by about 6,800 beds.

ThinkCo prepared an additional commentary on the influence of the coronavirus crisis on the student real estate market in Poland:

“It is natural to ask about the stability of the private student housing sector in the face of the coronavirus pandemic and the economic crisis. However, the current factors do not indicate that they may have a negative impact on the development of this market in Poland. For several reasons.

First of all, the market of private halls of residence in our country is still at an early stage of development, and even including all the investments which have been announced so far, it fills only a fraction of the demand. In the worst-case scenario, the annual increase in the number of international students will stop and even fall within the next few years. At the same time, however, institutional renting will be in even higher demand by international students. In this scenario, we have to assume that renting an apartment on a dispersed market will become extremely difficult for students coming to Poland due to the distrust of landlords.

A good quality private student house can, therefore, prove to be a solution for both foreign and Polish students – owing to stable rental, clear lease conditions and the ability to maintain student life even if temporary lockdowns are required. This observation is confirmed by the fact that although today students are asking for a rent suspension for the period of the pandemic, they do not terminate their contracts and say they will return to their student houses.

Ultimately, the attractiveness of this solution will also be important for parents, who, when deciding to rent a room in a student house, will have a peace of mind concerning the people their children meet and conditions in which they live in a foreign city or country.”

Przemysław Chimczak

CEO & Co-Founder

think co. - real estate research lab