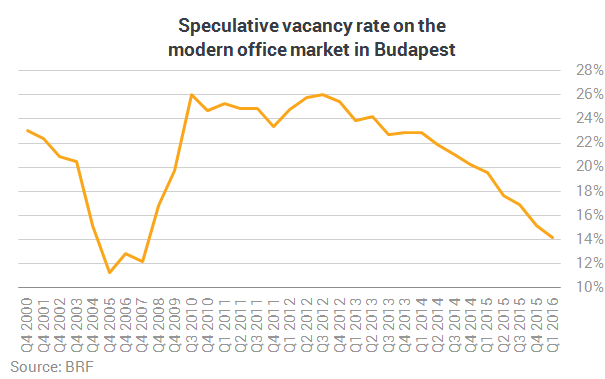

Vacancy rates have further declined on the Budapest office market as a result of modest development activity and strong demand from tenants. The Budapest Research Forum has published its quarterly office market analysis.

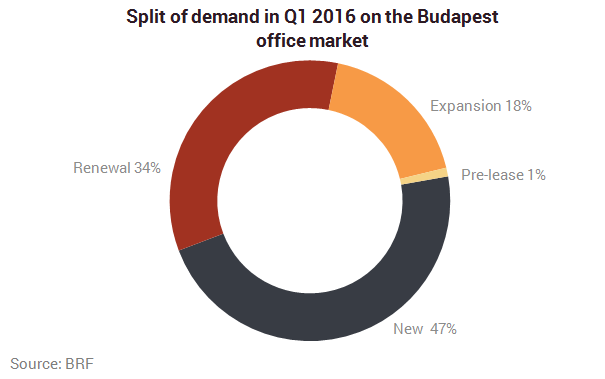

Demand in Q1 2016 was 30% higher than the 5-year average of the first quarter’ lettings, comprising 84,410 sq m, which is half of the record level registered in Q4 2015. According to the BRF, 212 lease agreements were signed in Q1 2016, with an average deal size of 398 sq m. The largest deal of the quarter was the GE expansion in the new Váci Greens B office building. This was followed by MSD’s renewal in the Millenium Towers III for 2,498 sq m. The largest new transaction was in Átrium Park, extending to over 1,800 sq m. The share of renewals and new deals shifted in Q1 2016 and new deals were the major driver of the market demand with 47% market share. Renewals accounted for 34%. Only 18% of the total leasing activity was expansion based. No owner-occupied transaction was registered in the quarter. At submarket level, Central Pest and the Váci Corridor had the highest leasing activity, both representing more than 20% of the market share.

Net absorption totalled 29,301 sq m in Q1 2016, of which Váci Corridor alone accounted for 14,109 sq m.