Globalworth has recorded a net operating income of €73.7 million in the first half of 2023, up by 5.6% compared to the same period of last year, while the development pipeline includes industrial projects in Romania and the refurbishment of mixed-use projects in Poland.

During H1 2023, the company completed the construction of the Târgu Mureș Logistics Hub, encompassing a total of 18,300 sqm fully leased to highly credible tenants. Simultaneously, progress continued on the development of the two final phases within Ștefănești Business Park, situated in the Bucharest Greater Area, which upon completion will contribute an additional 13,300 sqm to its industrial/light logistics portfolio in Romania.

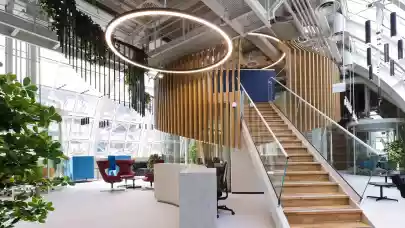

This year, the company anticipates the conclusion of refurbishment works on two out of the three mixed-use properties in its Polish portfolio.

“Beyond the overall positive tone of our operational performance and owing to the prevailing economic uncertainties and challenging market conditions, the value of our like-for-like standing commercial portfolio, as well as our total combined portfolio, decreased during the first half of 2023 by 3.0% to €2.8 billion and 2.5% to €3.1 billion, respectively. This decline is primarily attributable to the effects of revaluations in June 2023,” said Dennis Selinas, CEO of Globalworth.

The company’s total annualized contracted rent experienced a 6.8% surge, reaching €202.2 million compared to the year-end 2022 figures. Gross rental income increased by €5.1 million compared to the first half of last year as an effect of indexation of 8.8% that was partially offset by the reduced rates at which existing leases were renewed for an extended period or new leases were signed.

In H1 2023, the company managed the leasing of 181,000 sqm of commercial spaces, with a Weighted Average Lease Length (WALL) of 6.9 years. As of June 30, 2023, the average occupancy rate across our combined commercial portfolio stood at 85.5%.

However, during H1 2023 the company posted a net loss of €25.1 million, in contrast to the net profit of €32.6 million recorded in H1 2022.

“This transformation was primarily precipitated by a fair value loss on investment property, albeit partially offset by an augmented finance income resulting from the buyback of €100 million in bonds,” said the CEO in a report.

Looking forward, Globalworth mentioned that the limited supply of office spaces is expected to act as a catalyst, propelling rents and occupancy rates upwards, thereby fostering robust fundamentals for the office market.

“Despite prevailing challenges such as inflation and heightened stresses induced by higher nominal rates in the financing markets, there are discernible signs of macroeconomic variables stabilizing. Barring the emergence of unforeseen disruptions, both financial and real estate markets are anticipated to further solidify their stability,” concluded the CEO.