“Total commercial real estate investment in the Czech Republic recorded €490m in Q2 2016 contributing to an H1 2016 total of €950 million, a 26% reduction on the same period of last year. However, it should be noted that the considerable difference is due to the Palladium shopping centre transaction in H1 2015. When excluded, H1 2016 was 34% up on H1 2015,” says Jiri Horak, investment analyst at JLL.

25 transactions in H1 provided an average transaction volume of above €38 million. The retail sector reported a 47% share of total volumes followed by the office sector with 22%, the industrial sector with 8% and the remaining element in mixed and hotel asset classes.

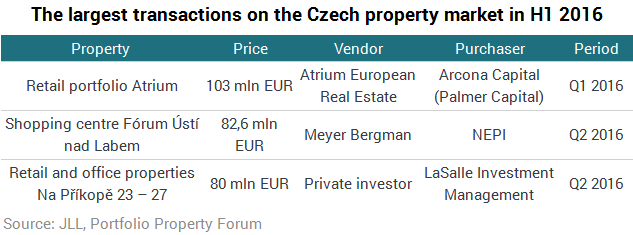

Notably, the largest transaction of the period was the sale of the Atrium portfolio by Atrium European Real Estate to Arcona Capital for ca. €100 million. During H1 2016, domestic equity further cemented its position within the well-diversified Czech capital pool; H1 saw 65% of offices and 59% of retail purchased by Czech entities. Of particular note was the purchase of an office portfolio in Prague by Redside, a domestic qualified investor fund, from Triuva. The portfolio consisted of four administrative buildings totalling 24,500 sqm located in Prague 4 and Prague 5.

“A sizeable pipeline across all sectors complimented by a supportive financial environment suggests that H2 2016 will report a high level of activity resulting in a full year figure similar to 2015 at ca. €2.5 to 3 billion,” adds Jakub Gajdos, investment analysts at JLL Prague.

JLL view on prime yields is the industrial and logistic sector at 6.50% but with further compression likely, prime offices at 5.25% but again, further compression anticipated on core product and prime shopping centre yields at 5.00%, with significant premiums possible on trophy and high street assets.