According to Colliers International’ COVID-19 Insights, it will take until at least Q2 2020 for the investment market to come to terms with what is a very sharp economic global shock and a potentially deeper economic shock for Europe.

European economic output is now expected to contract in H1 2020, which will generate a corresponding drop in investment volumes. The best-case hope is for a swift V-shape recovery in H2 2020, but current market conditions point to a more protracted economic shock, meaning a recovery may not be until early 2021. The market will recover, but as usual, this will occur at different recovery rates for each location. We will see some price corrections which may prove to be positive in the long run as it pre-emptively takes some of the pressure out of the market before a bigger bubble could emerge.

Some deals with active market players will continue to go ahead. The general view so far is that this is a temporary situation although the long-term economic impact is definitely a concern. That said, the technicalities of closings will become more complicated due to travel restrictions and government quarantines, so there is going to be some hiatus in acquisitions over the next quarter at least.

Markets benefiting from a depth of domestic and cross-border capital liquidity will remain selectively active. Investors taking core, long-term positions will most likely remain unperturbed by current friction and see this as an opportunity to take a stake in a market with less bidding competition. For very practical reasons, markets driven by greater levels of domestic core capital, or where global investors have local teams in position are most likely to function with less friction short-term. Some core capital, however, will be preserving cash, leading to reduced investment activity. This is already being felt in some locations.

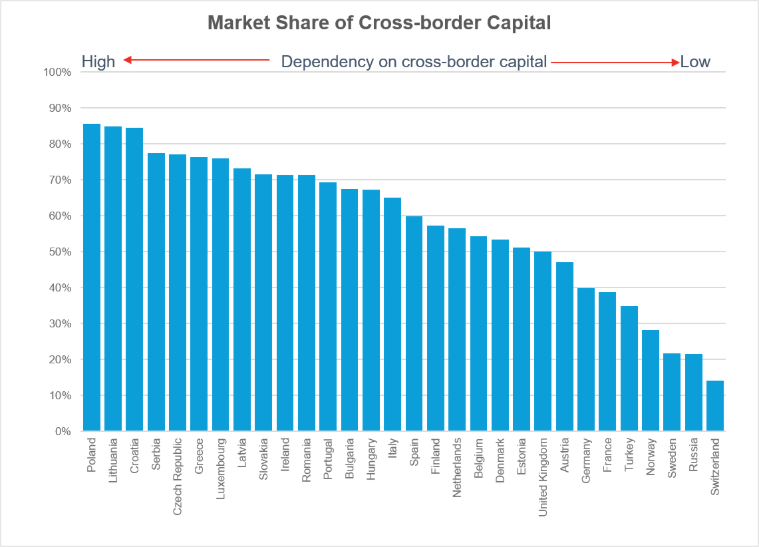

Data collected by Real Capital Analytics shows that CEE/SEE countries are among the most dependent on cross-border capital. Poland leads the European ranking with an 85% market share of cross-border capital but Hungary, where cross-border capital has a 67% market share, is also quite dependent in a European comparison. Colliers predicts that markets which are more dependent on cross-border investors are probably going to see a sharper contraction or push-back in new activity.

There will be a search for the availability of more defensive assets for sale – pricing may even tighten for these assets including offices on long leases to secure government covenants; defensive logistics, distribution and retail assets backed by grocery/pharmacy, e-commerce and needs-based products.

For value-add and opportunistic money, there is likely to be a postponement of activity until they see clearer results from any economic and sector fallout. US-based buyers seem particularly spooked and while some transactions are progressing, others are now taking longer to process. Some sales mandates are potentially being delayed by sellers worried about short term investor demand/pricing in the face of the current uncertainty. There is starting to be a lot of noise around ‘force majeure’ defaults and whether tenants can/will attempt to claim this. Retail tenants are already starting to postpone rental payments and with government-enforced shutdowns, the question will be whether the government will compensate tenants/landlords.

The exposure of a city market to short-term economic shocks in the hotel, hospitality and retail sectors will be under scrutiny, given that this could have a deeper impact on the broader city economy and other asset types in that location. There will be lots of eyes on the flexible workspace sector to see how it and the gig economy copes short-term. This, in turn, is likely to lead to a review of current yield pricing levels in some markets relative to the cost of capital and government bond spreads, and the impact of any rental softening on capital values. There has been such a broad and diverse policy response, enabling banks to remain lending and manage capital ratios in addition to the cutting of base rates. It will take some time before the market settles and pricing adjusts. Financing is already starting to become a question and will be tested in the coming weeks with scheduled closings.

There may be a need for certain investors to review their asset allocations, leading to some real estate sales to re-balance portfolios notably those in need of cash. The other challenge to cross-border capital is financial and FX rate volatility distorting the ability to determine income returns, in addition to the shift in yields and pricing that may occur if there is a prolonged downturn.