A total of 22 million sqm of prime industrial space is currently available for lease in Central and Eastern Europe. As a result, CEE is catching up on traditionally strong Germany, which has 25.5 million sqm and the number of its inhabitants is comparable with the region. The volume of new development for 2016 has reached a similar figure as in the record-breaking pre-crisis years of 2007 and 2008 when 2.5 million sqm was built annually. This makes it the third best year in terms of modern storage space built in the last 19 years.

“On average, more than one million square metres of new industrial space has been built over the last ten years. The fact that 2016 once again topped the two-million threshold illustrates the performance of the CEE countries’ economies and the positive growth of their GDP,” says Ferdinand Hlobil, Partner and the Head of the CEE Industrial Team at Cushman & Wakefield.

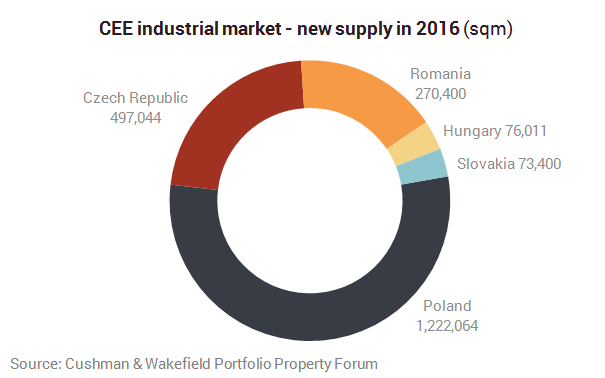

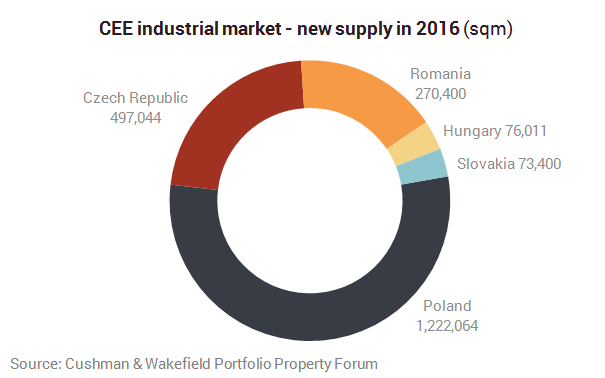

New industrial development traditionally focused on Poland with an increment of almost 1.2 million sqm recorded as the second best year in the last 19 years. A total of 500 000 sqm was built in the Czech Republic, a figure comparable with 2015. Romania made the biggest leap with almost 400 000 sqm of new development. That is more than the sum of all industrial space developed in Romania since 1998. Hungary experienced rapid growth too, with development multiplying more than 15 times compared to 2015.

Take-up

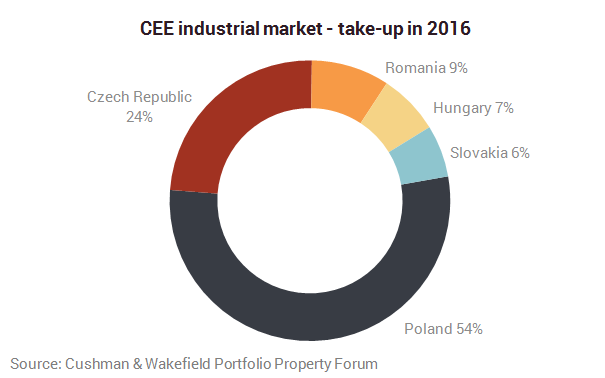

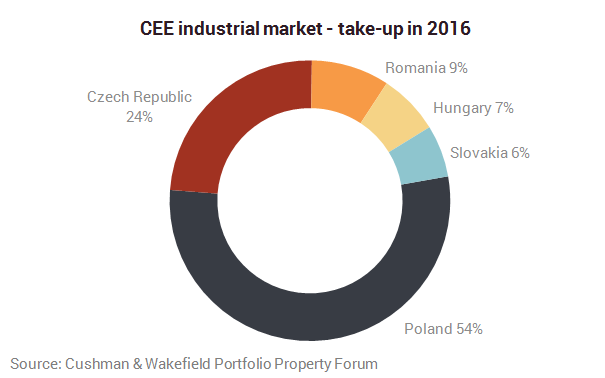

Out of the 5.7 million sqm, Poland and the Czech Republic account for more than three-quarters of take-up overall; 1.4 million sqm was leased in the Czech Republic as in the previous year. Poland, Romania and Hungary broke records. The biggest historical take-up was reported in Poland with a total of 3.1 million sqm, which is 25% more than in 2015. Romania and Hungary also encountered the highest take-up ever with almost half a million square metres leased in each country.

“There is a trend of an opening gap in rents. Locations with a sufficient supply of land experienced a slight decrease in rents in the past period. The lowest rental prices are available in Central Poland and Warsaw Suburbs in Poland. Conversely, rents tend to be the highest in capitals and will continue increasing,” Ferdinand Hlobil says.

Vacancy rate

Following three years of decrease, vacancy rate has grown by 0.4% over 2015 to a total of 6.1%. It stays within the healthy vacancy rate range (below 10%) despite record-breaking development.

Outlook

“For 2017 we expect the amount of development to be similar as in the previous year. Vacancy rate will remain around 6% due to the strong demand. The investment in the industrial sector is estimated at around EUR 1.4 billion,” Ferdinand Hlobil concludes.

Manufacturing investments will flow in primarily from the west of Europe. The factors that attract them to the region include the significantly lower cost of workforce and the growth of the consumer market.