Total real estate investment volume in the Czech Republic exceeded €3.7 billion in 2016, CBRE revealed. The most notable transactions in 2016 were the sale of P3 Logistics Parks, the Park and Florentinum, with 67 transactions being mediated on the Czech market in total.

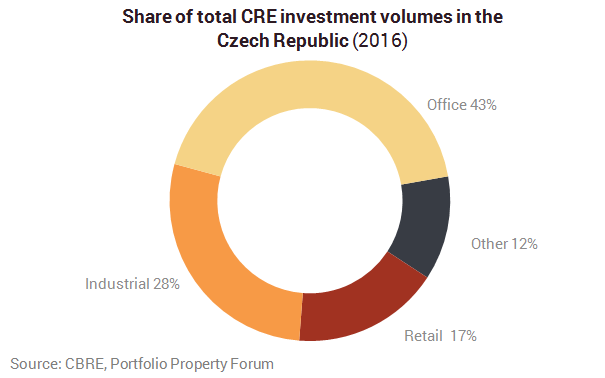

The market was dominated by investments in office properties accounting for 43% of all transactions, while industrial investment made up 28% and the retail sector constituted only 17%, compared to 2015, when it dominated the market. The largest number of transactions in the office sector took place in Prague, at 97%.

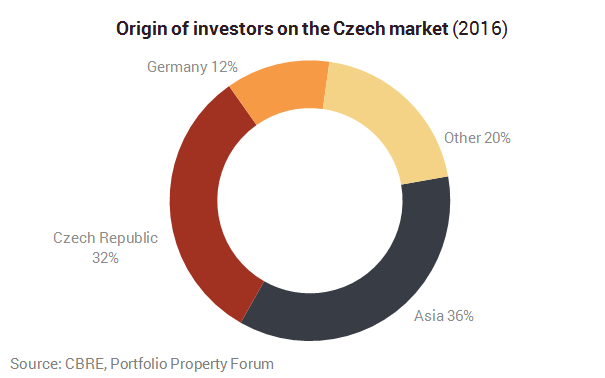

Investments by Asian investors in 2016 accounted for 36% of total investment, followed by investors from the Czech Republic (32%), with Germany coming in third (12%).