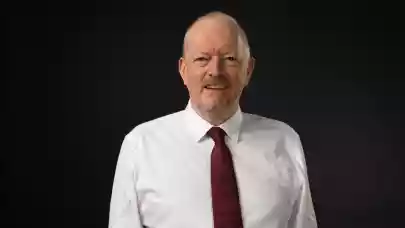

Richard Wilkinson, Chief Financial Officer of CTP, discussed the company’s newly expanded growth target and its strategic path toward 30 million sqm of gross lettable area by the end of the decade. In this interview with Property Forum, he explains what’s driving the company’s confidence in development-led expansion, how financing and ESG strategies are evolving, and where CTP sees the strongest potential across its CEE markets.

CTP recently expanded its mid-term GLA target to 30 million sqm. What motivated this decision, and how do you plan to finance such a large-scale expansion?

Previously, our target was 20 million by the end of the decade. By the end of this year, we expect to reach around 15 million, with 2 million square meters currently under construction. Recent delivery figures have been strong—1.1 million in 2022, 1.2 million in 2023, and 1.3 million this year. The 20 million target was no longer challenging, so we decided to set a more ambitious goal of 30 million by the end of the decade. CTP is focused on growth, primarily development-led, and with a 26-million-square-meter land bank across ten countries, we believe this ambition is achievable.

Will this growth be driven mainly by new developments, or do you also see potential in acquisitions?