Property investment volumes for the CEE region totalled €10.4 billion in 2020, 24% below 2019 levels. Poland, the Czech Republic and Hungary all saw year-over-year declines in volumes. Romania, Slovakia and Bulgaria all saw increases. By comparison, EMEA volumes are estimated to be down by ca. 27% YoY but Colliers’ latest reports indicates a strong rebound in 2021. Investor appetite remains strong for 2021 for the CEE region but will continue to be challenged by available product and the varying impact of COVID on certain sectors.

Kevin Turpin, Regional Director of Research | CEE adds: “Investment volumes in Poland accounted for 51% of the overall CEE-6 total. The Czech Republic followed with a 26% share thanks to a large residential portfolio sale. Many markets face a lack of available product as owners of the most sought-after assets are either long term holders or, are waiting for markets to settle, rather than selling at a discount”.

Kevin Turpin

Regional Director of Research | CEE

Colliers International

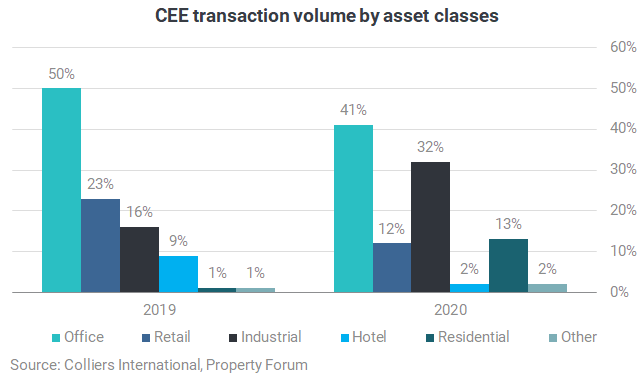

Despite a decrease year-over-year, the office sector maintains its top spot in terms of transactional activity, however, industrial volumes were up significantly as investors diversify into this seemingly COVID–proof sector and away from the more challenged Retail and Hospitality sectors. PRS is another sector to watch and is of high interest, but product remains limited across much of the region.

European and MENA capital (excl. CEE) led the investment volumes in 2020. The most notable deal was the acquisition of the Residomo residential portfolio by Heimstaden of Sweden. German, Israeli and Austrian capital also placed sizeable volumes of capital throughout the year.

CEE domestic investors have again been very active during 2020, particularly Hungarian and Czech capital.

Asian capital, specifically from Singapore, maintains it interest in the region. GLP’s acquisition of the Goodman industrial platform and GIC expanded its industrial portfolio. South Korean and Chinese and have also continued their run of activity, with further acquisitions, the majority of which have also been in the industrial and logistics sector.

“In terms of pricing, prime industrial & logistics yields have remained stable, with some compression in select markets. We have moved prime office yields out on average by 25 bps and prime shopping centres by 50 bps. Although there has been a lack of transactional evidence to support further movement in some sectors, our view remains that while some shifts are inevitable, core, well-performing assets should hold up well, with more pressure on secondary product” adds Kevin Turpin.