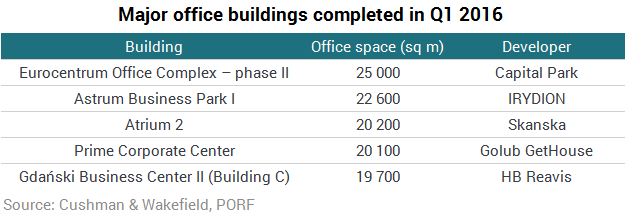

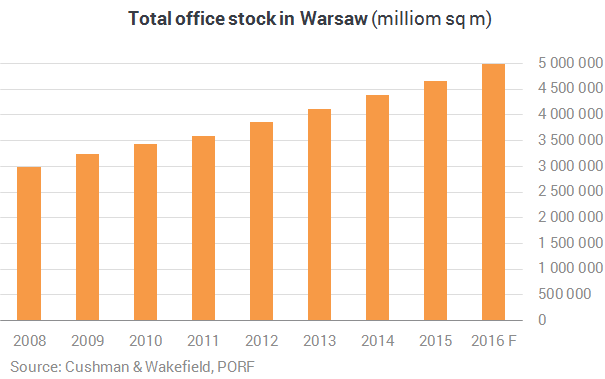

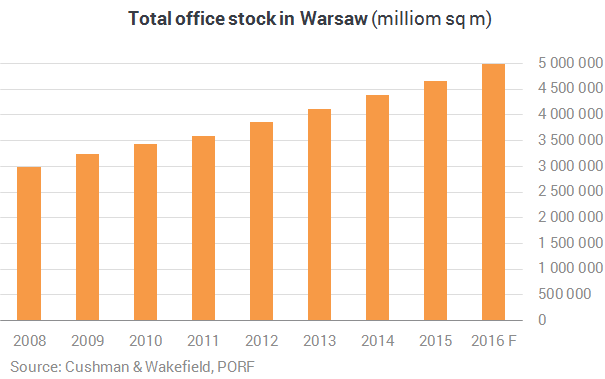

The total office stock in Warsaw reached almost 4.75 million sq m at the end of March, with approximately 30% of existing office space located in the city centre. In the first three months of the year, almost 113,100 sq m were delivered to the market (53,900 sq m more than in the same period of 2015), of which over 59% in non-central locations. Major buildings completed in Q1 2016 included the second phase of Eurocentrum Office Complex (Capital Park, 25,000 sq m), Astrum Business Park I (IRYDION, 22,600 sq m), Atrium 2 (Skanska, 20,200 sq m), Prime Corporate Center (Golub GetHouse, 20,100 sq m) and Building C of the second phase of Gdański Business Center II (HB Reavis, 19,700 sq m).

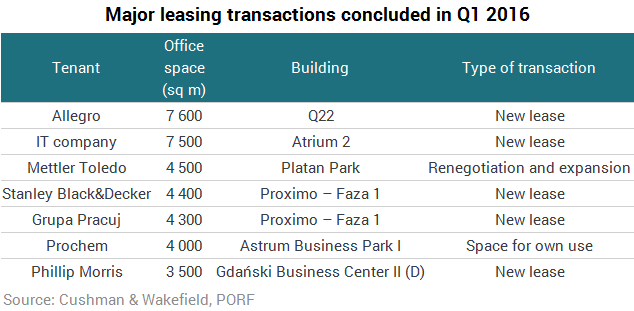

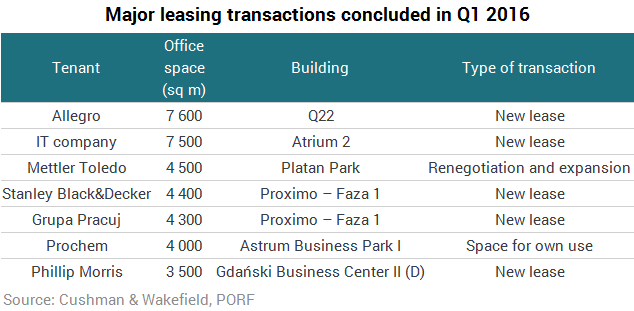

In the first three months of the year, leases were signed for the total of 142,200 sq m, which is over 15% less than in Q1 2015. The largest lease agreements concluded in Q1 2016 included the leasing of office space in Q22 by Allegro (7,600 sq m), renegotiation and expansion of Mettler Toledo’s offices at Platan Park (4,500 sq m), and leasing office space at Atrium 2 by an IT company (7,500 sq m).

After two consecutive quarters of decreases, vacancy rates grew to 14.1% as of the end of Q1 2016. This result is almost 1.9 pps higher than in December 2015 and nearly 1.1 pps higher than in Q1 2015. At the end of March, most vacant space was located in buildings in Upper South (229,800 sq m, up by 48,600 sq m) and Fringe (123,500 sq m, up by 16,900 sq m). Lowest vacancy rates were recorded in West (7%) and Lower South (9.2%). However, these zones are still not popular with office developers.

The current market situation continues to favour the tenants. However, base rents in the centre remained unchanged, amounting to EUR 24 per sq m per month in prime buildings. Modern office buildings in attractive non-central locations stayed within the EUR 13–16.5 per sq m per month limit. The only zone to report a decrease in rent rates was Upper South, where average prime rents fell to EUR 14 per sq m per month (down from EUR 14.25 recorded in December 2015). Coupled with a significant transaction volumes’ decrease in the Upper South (down by 26 pps as compared to the same period last year), this might suggest that the tenants are losing interest in the zone.

Due to strong competition on the market, developers and landlords continue to offer attractive incentive packages to their tenants, including rent-free periods and fit-out contributions. This allows the tenants to significantly lower the total leasing cost, both at the time of renegotiating current leases and when relocating to new buildings.

“While 2015 was record-breaking in terms of leasing activity and net absorption, the beginning of this year saw a slight decrease in these areas. However, supply is rapidly growing, which bodes well for companies looking to lease modern office space in Warsaw. The most interesting trend is the increasing outflow of tenants from the Upper South zone in Q1 2016, which used to be the most popular location for business. In the last three months, tenants were attracted mainly to the South West 1 and North subzones,” said Bolesław Kołodziejczyk, Senior Consultant, Consultancy & Research, Cushman & Wakefield.

Forecast for 2016

330,000 sq m of office space is expected to be delivered to the Warsaw market by the end of the year. However, 65% of this space remains unleased, and vacancy rates may continue to rise up to 16–17%. Continuing high levels of supply in 2016 will result in a growing competition and an increasing downward pressure on rents, especially in the case of older buildings in less attractive locations.

Although take-up was slightly lower than in the same period last year, taking into account both past data indicating lower tenant activity levels at the beginning of the year and planned lease transactions, gross take-up at the end of 2016 is expected to reach last year’s levels.

Over 50% of new supply will be constructed in the city centre. Major projects scheduled for opening in 2016 include Warsaw Spire – Tower (Ghelamco, 61,000 sq m), Q22 (Echo Investment, 50,000 sq m) and the next stage of the second phase of Gdański Business Center II (HB Reavis, 29,300 sq m).

“We are observing a shift in the making as more and more companies look to upgrading their office space through relocating into more modern office space or changing the way they use their premises. This trend should continue in the next couple of years and although vacancy may increase in older buildings, this will ultimately be absorbed by companies moving out from the older, more obsolete Class C buildings into relatively newer Class B buildings,” said Richard Aboo, Partner, Head of Office Department, Cushman & Wakefield.