The Warsaw office market maintains its strong momentum. This year’s total supply is expected to surpass 300,000 sqm, office take-up rose in the first three quarters of 2017 by 11.2% compared with the same period of 2016 and the vacancy rate is falling, shows the latest report by tenant-only advisory firm Cresa. The growth of the SSC/BPO sector and potential Brexit are likely to drive the Warsaw market going forward.

“Due to the growing demand, new office schemes in prime locations are being quickly leased. Most tenants have already noticed that there’s limited suitable space available in existing office buildings,” said Bartek Włodarski, Partner, Head of the Office Department, Corporate Solutions at Cresa Poland.

At the end of September 2017, Warsaw’s total office stock stood at 5.22 million sqm. The city’s vacancy rate remained largely unchanged at 12.9%, down by 1.0 p.p. q-o-q, as a result of strong demand mainly from new market entries but also thanks to expansion leases.

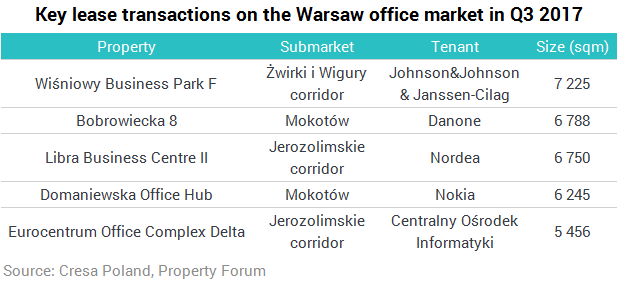

Tenant activity is soaring. Take-up in the first three quarters of 2017 totalled 588,400 sqm, up by 11.2% on the same period of 2016. The largest transaction of Q3 2017 was the 7,225 sqm lease signed by Johnson & Johnson and Janssen-Cilag at Wiśniowy Business Park F.

“We expect the Warsaw office market to continue its upward momentum. Warsaw is hoping to win a large pool of jobs from the UK following its departure from the EU, largely from mid-tier financial and technological companies. Poland remains an attractive destination for the SSC/BPO sector and is likely to attract new large market players. The only risk to the Warsaw market is associated with the upcoming changes to the International Financial Reporting Standards which may make long-term leases less attractive and force larger multinationals to decide to choose real estate acquisition or construction of schemes for owner-occupation,” said Bolesław Kołodziejczyk, Head of Research & Advisory, Cresa Poland.