Geneva has overtaken London at this year's edition of Arcadis International Construction Costs Index 2023. The report 'New Horizons'' covers 100 cities. The index is based on a survey of construction costs which covers 20 building functions.

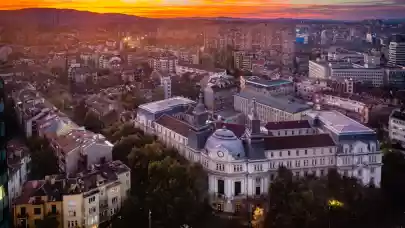

The Bulgarian capital ranks 69th, ahead of Budapest, Belgrade, and even Barcelona, Madrid, and Warsaw. Most of the top 10 cities remain unchanged with perennial European construction cost hotspots, Copenhagen and Zurich, high in the rankings. Munich has moved up to 5th place, highlighting not only the impact of a second year of punishing price increases in Germany but also the significant premium associated with building in the city – costs are 25% higher than in Berlin for example. Five of the top 10 are cities with dollar-denominated or dollar-pegged currencies, including Hong Kong. Boston and Philadelphia are new entrants. Their inclusion is mostly due to local inflation, although dollar appreciation during 2022 certainly helped.

Inflation Drivers – global trends and the Impact of the Ukraine War

Looking at the wider index, and for the second year in succession, high levels of inflation affected most cities in the survey. The invasion of Ukraine inevitably had a specific effect on costs in European markets, over and above the worldwide increase in energy costs. Construction was particularly exposed to the European energy crisis due to the energy intensity of manufacturing processes for steel, cement, glass, brick, and block materials.

Premium costs of net zero carbon

The cost data behind the ICC rankings also accounts for changes to specification. With further changes to building codes and specification standards associated with the pathway to net-zero carbon buildings, we are seeing further evidence of the cost implications of low-carbon design. The Nearly Zero Energy Building (NZEB) standard has been applied to EU markets since 2020, requiring improvements to thermal performance and some low-carbon energy sources. More recently in 2022, the UK launched an interim step to a fully net-zero specification for residential and non-residential buildings.

The impact of higher finance costs

Demand for housing will inevitably be hard hit by affordability issues triggered by higher mortgage rates. However, the impact could spread much further. Evidence of the broader effect of the interest rate cycle is plain to see. Property-related shares fell significantly during 2022, and as we write in March 2023, the UK's FTSE 350 Real Estate Index and the Dow Jones US Real Estate Index are both 30% below price levels seen in December 2021. Given the hefty discount to asset value, some developers are paying off expensive debt with sales proceeds rather than taking forward new development. Some sectors are much more resilient. Multifamily rental housing development for example continues to benefit in many markets from high levels of demand and a shortage of supply existing commercial property is doubly exposed. Not only have finance costs increased by 400 basis points or more, but income streams and asset values are reduced by a higher discount rate, cutting the present-day value of the benefits that can result from energy-saving low-carbon investments. Lower asset values could trigger further risks associated with loan-to-value covenants and funding gaps. According to Bloomberg, the global stock of distressed debt in Real Estate totals nearly $150 billion. The factors affecting long-term value are complex and interlinked. They vary by city, location, and by asset type. In US cities where home working has become much more entrenched since Covid-19, economic obsolescence has become a real threat to asset value, particularly in city centers. By contrast, in the UK and European cities, office working is re-established, but the division between high-quality and non-performing workspace, and between prime and secondary locations, has accelerated. In both situations, existing assets need investment to remain competitive, but the solutions differ.

As property markets evolve, Environment, Social, and Governance (ESG) expectations and reporting standards are also getting tougher, such as the EU's updated Sustainable Financial Disclosure Regulation (SFDR) and the EU's Investment Taxonomy, which is having a direct impact on portfolio selection and performance reporting. New Nationally Determined Contributions (NDC) associated with the Paris Accord and COP 27 ambitions mean that more regulatory net-zero deadlines are in the pipeline, which means that leading-edge standards that are currently seen in the EU are likely to be applied to a wider range of markets, including the US.