The first 3 quarters of 2020 across the CEE-6 have seen a 37.5% decrease (year-on-year) in overall office investment volumes. With positive news of vaccines due for deployment early in the new year, offices volumes are expected to rebound in 2021 according to a new report by Colliers International.

New office supply across the CEE region has so far been relatively unaffected. Net take-up across most office markets for the first 3 quarters of 2020 has declined between 27% and 46% as occupiers take a wait-and-see approach. Over the Q2 and Q3 periods of 2020, there was an increase in the amount of space that occupiers have offered up for sub-lease and although technically still leased, it does raise the amount of available space on the market.

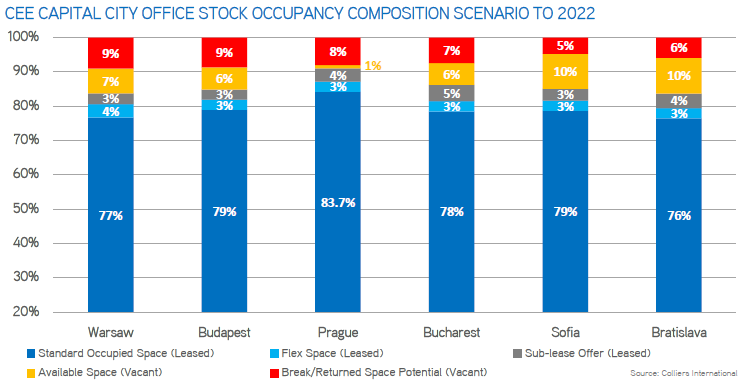

The possible composition of the office stock by the end of 2022

Colliers has used the following assumptions to illustrate how the composition of the stock might look by the end of 2022:

- One percentage point increase in the office stock occupied by flex operators.

- A conservative doubling of the Q3 2020 volumes of space offered for sub-lease.

- A 30% reduction in net absorption for the period Q4 2020 – 2022.

- A proportion of space returned (calculated as 30% of recent gross take-up volumes), due to potential space reductions or exercised lease events.

- The delivery of a pipeline of projects that are currently under active construction and due for completion by the end of 2022 (less pre-let space).

Office supply and pipeline

“New supply levels, meaning space that is actively under construction, and planned for delivery in Q4 2020 and into 2021 and 2022 do vary quite considerably across the region for city-specific reasons. Fairly strong supply pipelines are expected in Bucharest, Budapest, Sofia and Warsaw in 2021. Depending on how the situation with the pandemic evolves over the next 6 to 12 months we might expect to see some delays to projects that have not yet commenced construction. Office projects that require a certain level of pre-lease in order to secure development financing could also potentially expect some delays. From the ca. 2.1 million sqm under active construction across the region, and due for delivery until 2022, an average of 40% of space is already pre-let,” Kevin Turpin, Regional Director of Research | CEE explains.

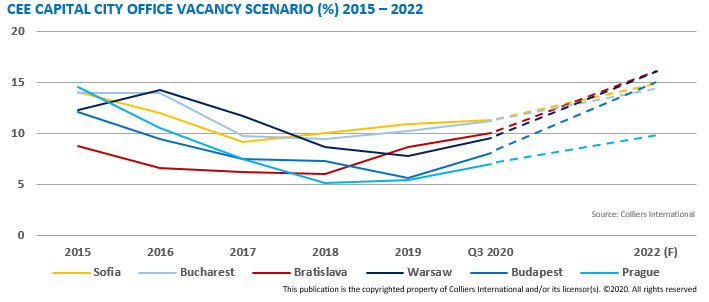

Vacancy scenario by the end of 2022

“There is much speculation about vacancy rates in the office property sector as a whole rising to record levels, based on upcoming supply levels and reduced demand. Based on the above scenario and assumptions, this is one view of how vacancy could look by the end of 2022. As mentioned, it is possible to create a variety of scenarios by playing with demand and returned space data points, however market evidence remains inconclusive, but as such, cannot be ruled out” adds Turpin.

Office demand

Net take-up across most office markets for the first 3 quarters of 2020 has declined between 27% and 46% as occupiers take a wait-and-see approach. These figures are on also the high side as most markets saw record levels of take-up in the last couple of years.

Tenants are looking at their options and looking at ways to cater primarily for their people as their most important assets. This involves working with, or around, the health and safety guidelines they have, in how to effectively use or adapt their core office space, how flexible office solutions might be used and what makes the most sense in terms of having employees work from home long-term.