At the end of H1 2016, Poland’s office stock totalled 8.7 million sqm. Warsaw remains the largest office market with Kraków, Wrocław and Tricity becoming major regional office hubs. Nearly 572,000 sqm of modern office space was delivered onto the Polish market in H1 2016, setting a new semi-annual record. Cushman & Wakefield its newest report, Property Times: Office Market In A Growth Phase.

At the end of H1 2016, the total office stock in Warsaw and eight largest regional cities (Kraków, Wrocław, Tricity, Katowice, Poznań, Łódź, Szczecin and Lublin) stood at 8.7 million sqm. The largest office markets are: Warsaw (4.99 million sqm), Kraków (833,000 sqm), Wrocław (757,000 sqm) and Tricity (629,000 sqm).

In H1 2016, the Polish market posted a new high in terms of office supply which totalled 572,000 sqm, of which 350,000 sqm (58%) was delivered in Warsaw and the remaining 222,000 sqm (42%) in regional markets. The largest completions were in Warsaw, including Ghelamco’s Warsaw Spire Tower (59,100 sqm), HB Reavis’ Gdański Business Center II (buildings C and D totalling 49,000 sqm) and Echo Investment’s Q22 (46,400 sqm). Office schemes which received occupancy permits in regional cities included the following: Echo Investment’s Tryton Business House in Gdańsk (21,300 sqm), Echo Investment’s O3 Business Campus I in Kraków (19,200 sqm), GTC’s University Business Park in Łódź (18,700 sqm) and UBM Polska’s Pegaz in Wrocław (18,500 sqm).

In H1 2016, the lowest supply of office space was in Szczecin, where only 7,200 sqm was delivered, whilst no new space was added to Lublin’s office stock.

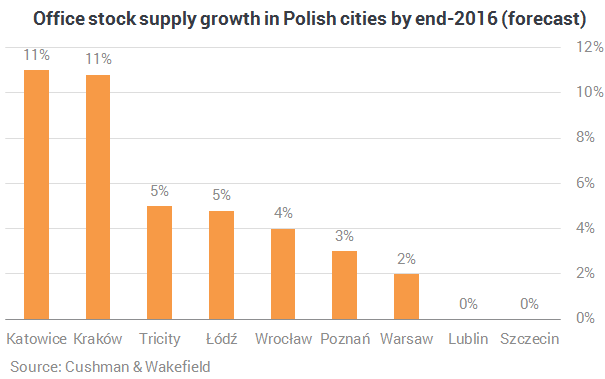

Bolesław Kołodziejczyk, Senior Consultant, Consulting & Research, Cushman & Wakefield, said: “Some 310,000 sqm is likely to be added to Poland’s office stock by the end of 2016, which is why we are expecting the annual supply to set a new record high. Among the regional cities, the highest levels of new supply are expected in Kraków (87,800 sqm), Tricity (46,800 sqm) and Katowice (44,700 sqm). Given the development pipeline for 2017–2018, if all the currently planned projects, that is more than 1.5 million sqm, of which around 771,000 sqm is to be delivered in Warsaw and 751,000 sqm in regional cities, come to fruition, supply levels are likely to remain equally high over the next two years.”

Net absorption was positive and totalled 280,000 sqm at the end of H1 2016, down by 2.8% on H1 2015. The largest hikes in occupied space were in Warsaw (133,400 sqm), Kraków (48,000 sqm) and Tricity (31,500 sqm), whilst absorption levels fell in Katowice (-68%) and Szczecin (-78%) compared to H1 2015. High supply levels in most cities pushed vacancy rates up, averaging 13.4% for Poland and 10.8% for its regional markets. The lowest vacancy rate was in Kraków (6%), whilst the highest in Szczecin (17.7%). Compared to the end of H1 2015, the strongest rise in vacancies was in Katowice (up by nearly 6.5 percentage points), whilst Poznań saw the largest decrease in the volume of vacant office space.

Richard Aboo, Partner, Head of Office Agency, Cushman & Wakefield, said: “The last 6 months saw increased activity from both the supply and take up side, which clearly shows encouraging signals that Poland still remains an attractive place to locate business, especially in the tech and financial sectors. This is expected to continue to the end of the year with 2016 being yet another record breaking year.”