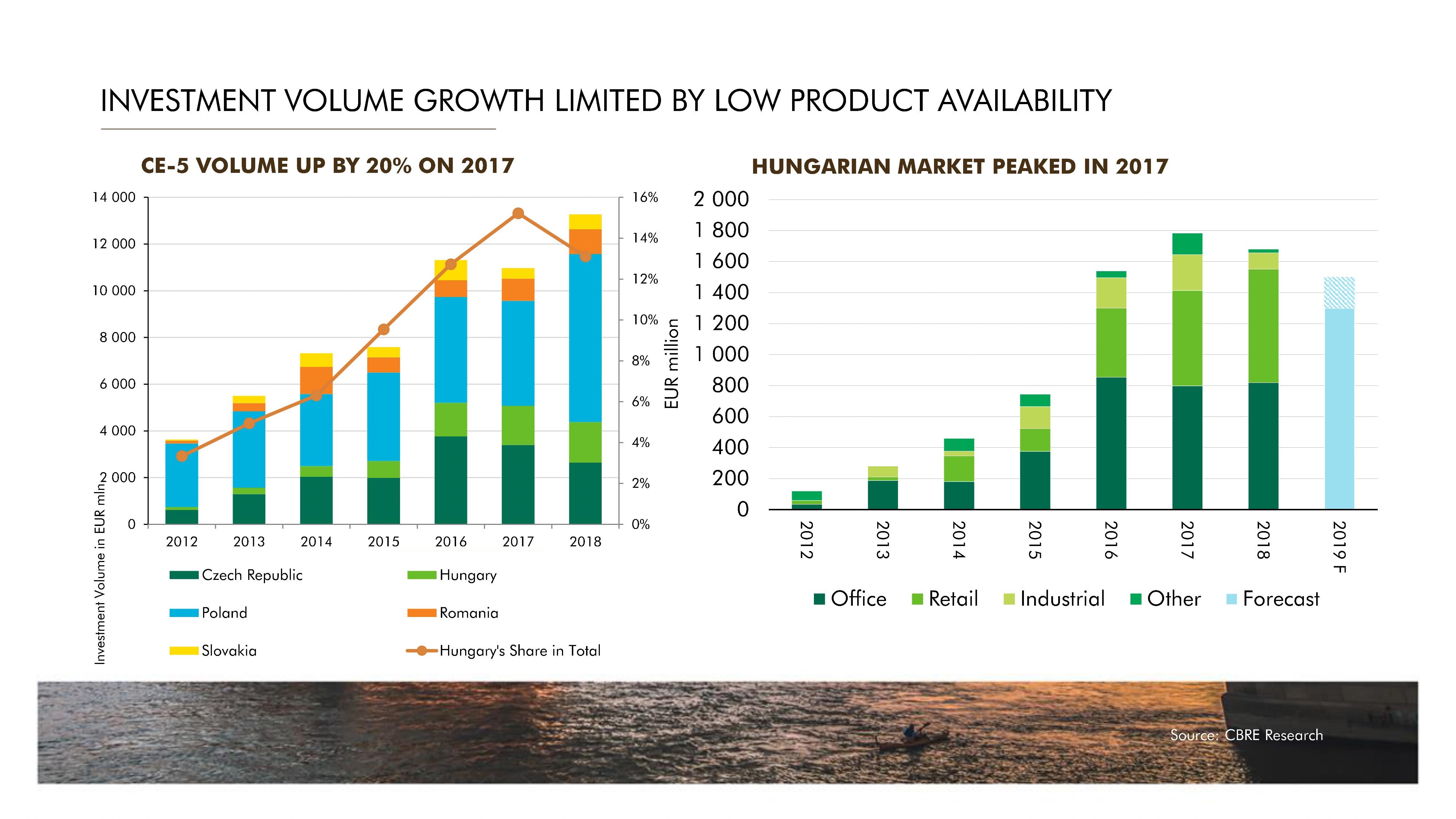

Hungary’s investment market peaked in 2017 but a solid €1.8 billion was transacted in 2018 with local investors closing 65% of purchases on the buyer side. Property Forum summarised some of the key market trends presented at CBRE’s yearly Re-View business breakfast.

Economic growth

- Economic growth in Central Europe remains twice as high as in the core Eurozone.

- Hungary’s GDP growth peaked in 2018. There is a slow deceleration ahead.

- Hungary currently has the strongest economic sentiment in the EU.

- Construction sentiment is also one of the strongest in the EU.

Investment

- Hungary’s investment market peaked in 2017 but a solid €1.8 billion was transacted in 2018.

- In terms of asset classes, industrial will become more popular in 2019. There is a weight of money looking at logistics, but there is not much to sell.

- Hotels are being overlooked while ‘others’ such as residential will come up even though the products are not really ready yet.

- Many large retail assets traded in the recent period, so retail’s share will be lower in 2019.

- The Czech investment market is slowing down due to lack of stock which might be an indicator for the future of the Hungarian market.

- Hungarian investors made 65% of purchases in 2018. Based on last year’s figures, US investors are leaving, German and Austrian investors are coming back and cross-CEE investments are increasing.

- Most of the yield compression has already materialized. As of Q4 2018, offices trade at 5.75%, retail assets trade at 5.50% and industrial yields stand at 7.50%.

New developments

- Banks are willing to compete for the right investment product, but for development loans, pre-leases are still a must.

- Construction costs keep increasing and in many cases, the rental increase doesn't really make up for the higher costs. Some projects are being put on hold.