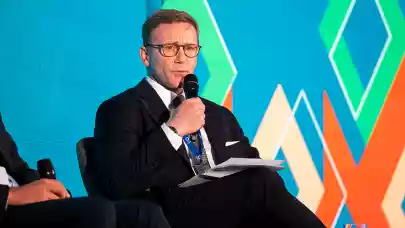

In a video interview recorded at CEE Property Forum 2025 in Vienna, Philipp Zschaler, Managing Partner and Head of the Real Estate Industry Group at Andersen Germany, shares his expectations for the CEE real estate market in 2026. He reflects on liquidity conditions, shifting investor profiles, key risks and the asset classes likely to benefit from ongoing transformation.

As a transactional advisor, what are your expectations for the real estate sector in the CEE region for 2026?

We spoke at the Forum about what was described as a major capital hunt for 2026, but it became clear that it is not just a hunt for capital — it is more a hunt for assets. There is a lot of liquidity in the market, and investors are actively looking for opportunities.

The real challenge, however, is finding the right assets. If the right products come to the market, I am confident that transaction volumes and activity will increase.

International or regional players will be responsible for more deals, looking ahead?

Looking at the deals we have seen this year and the forecasts for next year, it is clear that there is more regional capital active in the market. At the same time, investors from Western Europe, the UK and the US are, in many cases, reducing their exposure.

I expect this trend to continue next year, with local and regional capital playing a more dominant role in CEE transactions. That said, I believe it will ultimately be a mix.

What could be the cause of this shift?

Geopolitics clearly play a role at the moment, particularly the uncertainties linked to the war and broader global tensions. At the same time, we are seeing major transformation processes underway.

Investors are continuously reassessing asset classes and markets, looking for diversification. In that context, it is understandable that local and regional capital is currently more active, as it tends to have a stronger familiarity with the market environment.

What are your clients’ biggest fears? Are there any risks they are talking about?

The geopolitical situation is clearly the biggest concern and has a tangible impact on decision-making. Beyond that, transformation is a recurring theme. Financing conditions are relatively stable, so the framework itself is solid, but there are many external influences to consider.

Technology, AI and demographic change are all reshaping the market. Rather than one single dominant fear, clients are focused on navigating multiple challenges at once. This requires sensitivity and a clear understanding of where markets are heading.

My impression is that professionalism in the market continues to increase. Despite ongoing discussions about resilience, the market is managing these challenges well. Investors tend to focus more on opportunities and adaptation than on fear.

Which asset classes could be the winners?

Overall, we are seeing a more diverse market with a growing range of asset classes. Demographics are driving demand for healthcare, nursing homes and hospitality assets.

Technology is another key factor, particularly data centres. Logistics has already been a strong driver for several years and is likely to remain so. Infrastructure also stands out as an area with significant long-term investment potential.