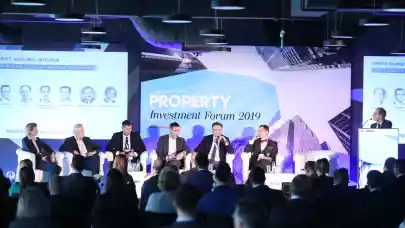

There’s a lot of capital targeting real estate in Central & Eastern Europe but finding the right investment product remains a huge challenge. Panellists of the CEE investment panel at Portfolio Property Investment Forum 2019 in Budapest discussed the risks investors in the region need to keep in mind.

According to Jan Hübner (HB Reavis Hungary), there is so much money on the market right now that people tend to invest in premium products even when they know that that product might fail. Benjamin Perez-Ellischewitz MRICS (JLL) emphasised the importance of looking at local specifics when interpreting global trends as he explained that retail is not an attractive asset class among investors in Europe these days but shopping centres in Budapest are performing really well and they continue to attract investor interest. Speaking about alternative investments, Tom Lisiecki (TriGranit) added that investors are looking at asset classes that haven't existed before because there aren't enough tried, tested and trusted products on the market.

According to Dr. Edina Schweizer (Noerr), banks are looking for good quality properties with good quality owners and developers with Rudolf Riedl MRICS (Strabag Real Estate) adding that banks want to finance income-producing assets.

Logistics has long been one of the preferred asset classes of investors, but, according to Martin Polák (Prologis), there are not many products to buy on CEE industrial markets. He added that currently there is a 1.5 pps yield difference between Budapest and Prague on the industrial market which he finds unreasonable.

Panellists also discussed how regional economies are dependent on Germany, especially on its automotive industry which is especially vulnerable right now. Not every factory in the automotive industry is ready for the transition that we’re going to see in the coming years, Martin Polák added.

Jan Hübner explained that the situation on the Budapest office market is very good, there is strong demand supported by economic growth. Although Tom Lisiecki agreed that rents are rising, in general, he also emphasised that tenant incentive expectations are twice as what they were before the crisis which means that rents for large tenants are almost the same as they were 10 years ago. He also shared his concerns about the office markets in the regional cities of Poland, explaining that although demand is keeping up with the current really strong supply, for now, thanks to expansions, new BPOs and SSCs haven't entered the market in several years.

Economic and political risks were important topics that came up several times during the discussion. There is so much uncertainty out there that it's impossible to say when an event will happen that affects everything, Dr. Edina Schweizer said. However, in case a crisis hits we are much better prepared than we were before, Martin Polák added.

Jean-Bernard Wurm (Secure Legal Title, London), the moderator of the discussion, added that recently it has become more common to see red flags during the due diligence process.

Investors are looking for political and economic stability and they generally don't care if a government has autocratic features as long as it’s stable, Dr. Edina Schweizer concluded.