Unusually, due to the current situation, Euroconstruct has issued an interim forecast which is a revision of the June construction market forecast. The results have been summarised by János Gáspár, head of Euroconstruct's Hungarian research institute, Buildecon.

The shrinkage of the total Euroconstruct construction market in 2020 is expected to be less harsh according to the interim forecast, and recovery is on from 2021. This recovery is not super fast, though, as the 2022 level is still foreseen to be below the 2019 level. In the latest outlook, 2020 could end up with an around 9% decline in the Euroconstruct area. Among the biggest markets, the UK seems to be hardest hit by the consequences of the pandemic. Excluding the UK the decline in real terms is around 7% this year.

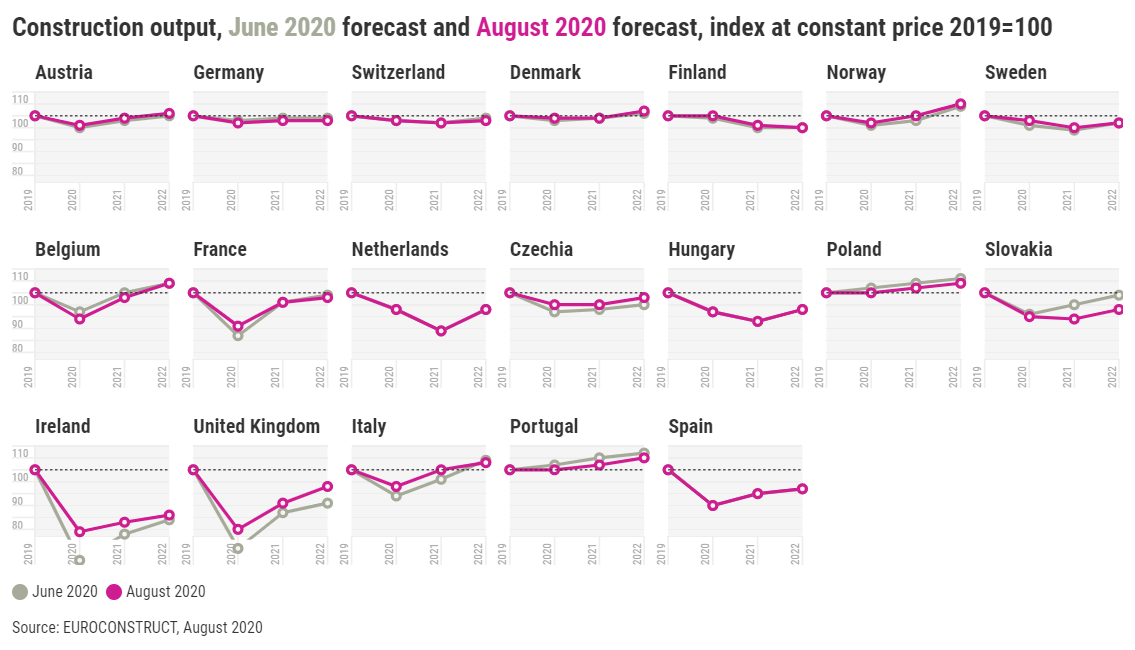

In most countries the stories after the revision remained pretty similar to those we forecast in June. Charts below are organized by region, the dotted black line represents the 2019 level. At Europe’ heartland and in the Nordic countries (in the top row) there are very stable markets. Except for Finland and Sweden, each of them foresees the total market in 2021 to be around the level of 2019. Out of the largest countries, the most sluggish recovery could be in the Netherlands, in the UK and in Spain. Poland seems to be crisis-resistant.

Buildecon, the Hungarian research institute of Euroconstruct and the author of the Hungarian report, maintains its June forecast for the Hungarian construction market over the forecast horizon based on the assumption that there will be no pandemic-related construction ban in Hungary. This year, Buildecon still expects an 8% decline in the entire Hungarian construction market. It expects negative construction output in 2021 as well (-4%). So while maintaining the June forecast, Buildecon says the trajectory is far from V-shape over the forecast horizon. Buildecon is most pessimistic in housing and civil engineering. The forecast, with the outlook for each segment, is available for purchase from Buildecon.