Prime headline rents have increased slightly to a new level of €5.20 sqm/month in the Czech Republic and €5.50 sqm/month in the Greater Prague region during Q3 2021. The Industrial Research Forum published its fresh industrial market figures.

- The amount of completed space in Q3 2021 was the largest since Q2 2020, mainly in Greater Prague and Pilsen.

- The most extensive new construction commenced in the Olomouc region – a new distribution centre of Amazon.

- Industrial space under construction currently accounts for almost 900,000 sqm.

- Net quarterly demand exceeded the record levels set last quarter with a volume of 447,800 sqm, creating a new maximum since the beginning of measuring.

- The decreasing vacancy rate continued in Q3, leaving the Czech Republic with just 2.5% of the vacant industrial stock.

- The highest achievable rent in Prague has again increased to the new level of €5.50 per sqm per month. Attack of the €6.0 level is expected.

Total stock & new supply

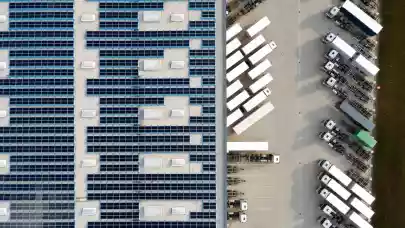

The total area of modern industrial space for lease in the Czech Republic increased to 9.49 million sqm in the third quarter of 2021. A total of 176,600 sqm of new warehouse space was delivered to the market within 12 industrial parks across the country. This represents a 16% increase compared to the same period last year and a 68% q-o-q increase. At the time of completion, approximately 94% of the projects were already pre-leased.

The most significant completion was a 62,100 sqm hall located in the CTPark Bor in Pilsen Region. The hall was pre-leased entirely to a confidential logistics company. The second-largest completed building of 21,400 sqm, located in the Prologis Park Prague - Úžice, followed by the completion in Panattoni Park Stříbro (16,300 sqm), both leased to undisclosed producer companies.

Projects under construction

At the end of the third quarter of 2021, over 897,300 sqm of industrial space was under construction, increasing by 33% compared to the previous quarter. 25% of this area is located in the Olomouc region, 19% in the Moravia-Silesia region, and 12% in the Southern Moravia region. Developers commenced constructing 344,900 sqm during Q3 2021, with part of 186,700 sqm in the future distribution centre of Amazon, situated in the Olomouc region. The share of speculative space under construction increased to 26% in the third quarter.

Industrial take-up

Gross take-up (including renegotiations) totalled 495,500 sqm in the third quarter of 2021, representing a 6.5% decrease compared to the previous quarter. In a year-on-year comparison, we register a significant increase of 60% in total take-up during Q3.

The share of renegotiations decreased again from 27% to just 10% (i.e., 17 percentage points) compared to the previous quarter, with a year-on-year decrease of 36 percentage points.

Net take-up in Q3 2021 reached 447,800 sqm, surpassing the highest quarterly level in history set in the previous quarter. Significant increase by 15 % compared with last quarter, and a 171% increase compared to the same period in 2020. Net demand was driven mainly by distribution companies (primarily from the e-commerce sector), which accounted for 46% of the volume, followed by logistics companies with a 21% share.

Major leases within take-up

By far, the most significant transaction in the third quarter of 2021 was a pre-lease signed by the global e-commerce behemoth Amazon in the Panattoni Park Kojetín with a size of 186,700 sqm. The second-largest lease transaction was a renegotiation with a total leased space of 30,500 sqm in Euroform Trmice signed by the manufacturing company StanleyBlack&Decker. The third-largest closed deal was a pre-lease of 22,800 sqm in CTPark Cheb by the logistics company DHL.

Vacancy

In the third quarter of 2021, the vacancy rate declined again to 2.5%, representing a decrease of 37 basis points compared to the previous quarter and a fall of 209 basis points compared to the same period last year. At the end of the third quarter of 2021, a total of 234,800 sqm of modern industrial space was on the market, available for immediate lease. The vacancy rate in the Greater Prague region increased by 64 basis points to 2.0%. If we exclude vacant offices and focus only on empty warehouse space, the rate for some regions, especially Greater Prague, is several tenths of basis points lower.

Rent

Prime headline rents have increased slightly to a new level of €5.20 sqm/month in the Czech Republic and €5.50 sqm/month in the Greater Prague region during the third quarter of 2021. Rents for mezzanine office space stand between €8.50–9.00 sqm/month. Service charges are typically around €0.50–0.65 sqm/month.

The Industrial Research Forum was established in 2010 with its aim to provide clients with consistent, accurate and transparent data about the Czech Republic industrial real estate market. The members of the Industrial Research Forum, CBRE, Colliers, Cushman & Wakefield and JLL, share non-sensitive information and believe the establishment of the Industrial Research Forum will enhance transparency on the Czech industrial market.