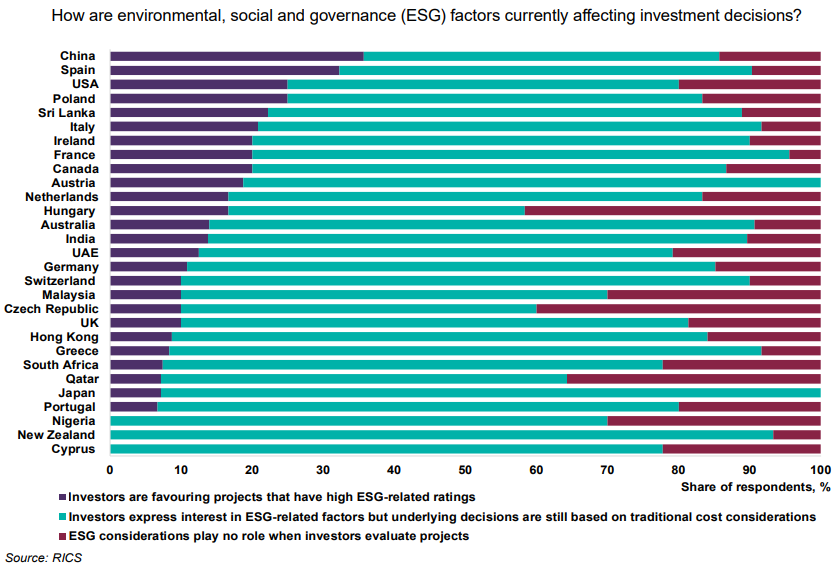

While in Poland over 20% of investors are favouring projects that have high ESG-related ratings (which is fourth highest figure globally), Hungary and the Czech Republic are the two countries with the highest share (over 40%) of respondents saying that ESG considerations play no role when they evaluate projects, according to the latest results of the RICS Global Commercial Property Monitor.

As part of the Q3 2020 RICS Global Commercial Property Monitor, respondents were asked a series of additional questions focussing on how preferences have changed for green buildings in the past year, the impact on rents and prices and to what extent ESG factors are affecting investment decisions.

Key findings:

- Occupier interest for green buildings has risen by some degree over the past twelve months.

- Across Europe, more than half of participants noted an increase in interest for buildings with green certifications.

- More than one-third of contributors believe that green buildings receive a rent premium over comparable non-green buildings.

- In Europe, 45% of participants noted that green-certified buildings are subject to a price premium, higher than in any other region.

- The majority of contributors (around 64%) believed that while investors have expressed interest in the ESG related factors, the underlying decisions were still based on traditional cost matters.

Demand for green buildings trending higher

Survey feedback from across the commercial property sector suggests that occupier and investor interest for green buildings has risen by some degree over the past twelve months. Globally, almost 40% of survey participants believe that occupier demand for buildings with green building certifications has risen modestly in the past year. This share is slightly higher in Europe, with around 43% of contributors noting a modest increase. Nonetheless, it is worth noting that a sizeable share of contributors globally and across all regions state that there has been no change in occupier demand for buildings with green certifications.

Across the investor side of the market, while around 47% of the survey’s contributors globally see investor demand for green buildings to have risen in the past twelve months, an equal share note no change. Still, across Europe and APAC, more than half of the participants noted an increase in interest for buildings with green certifications. The share of contributors taking this view is the lowest across the Americas, as around one-third of participants report a rise in investor appetite for green buildings in the last twelve months while more than 50% believe there has been no change.

Green ratings add premiums to rents, prices

Even if demand has only risen relatively modestly, feedback suggests that green building certifications are having an impact on rents and prices. Globally, around 35% of contributors believe that green buildings receive a rent premium over comparable non-green buildings. The majority (more than one-fifth) state that the rent premium is up to 10%, with only 7% judging it to be higher. Meanwhile, almost 40% state that even if there is no rent premium for a green building, those without a green certification are subject to a brown discount.

Regarding price premiums, 42% of survey participants globally state that green-certified buildings attain a price premium over comparable non-green buildings. Similar to the occupier side of the market, the majority state the price premium is up to 10%. Alongside this, around one-third of the survey’s contributors believe that there is no price premium however buildings without a certification are subject to a discount. This pattern seems to be more prevalent across Europe and MEA as 45% of participants note that green-certified buildings are subject to a price premium, higher than in any other region.

ESG not the determining factor for investors

With respect to how Environmental, Social and Governance (ESG) factors are affecting investment decisions, around one-fifth of contributors globally note that investors are favouring projects with high ESG ratings. Meanwhile, the majority of contributors (around 64%) believed that while investors have expressed interest in the ESG related factors, the underlying decisions were still based on traditional cost matters.

When disaggregated, feedback from European countries depicts a slightly more encouraging picture. Out of the top 10 countries that have the highest share of contributors that believe investors are favouring projects with high ESG-related ratings, 6 of them are in Europe. Indeed, Spain, Poland and Italy are close to the top of the list while a modest shift in investors’ preferences for ESG factors also noted from contributors from the Ireland, France and Austria.

Nevertheless, it does seem like sustainability and environmental factors are still not at the forefront of mainstream investment decisions across the majority of countries. Across prominent commercial property markets, the share of respondents seeing investor’s favouring projects with high ESG-related ratings is less than 10% in the UK and Japan and virtually zero in New Zealand.

Hungary and the Czech Republic are the two countries globally with the highest share (over 40%) of respondents saying that ESG considerations play no role when they evaluate projects. At the same time, it is worth noting that around 10% of investors in the Czech Republic and 16% in Hungary are favouring projects that have high ESG-related ratings.