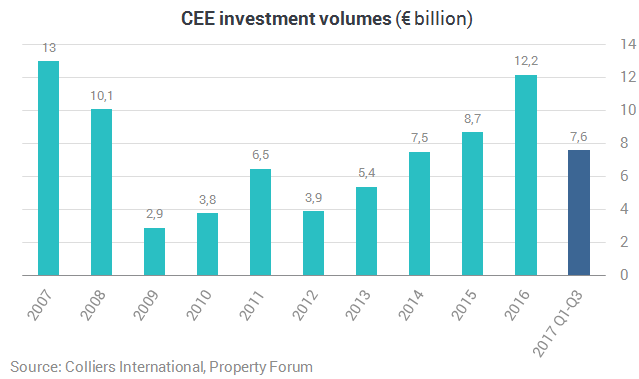

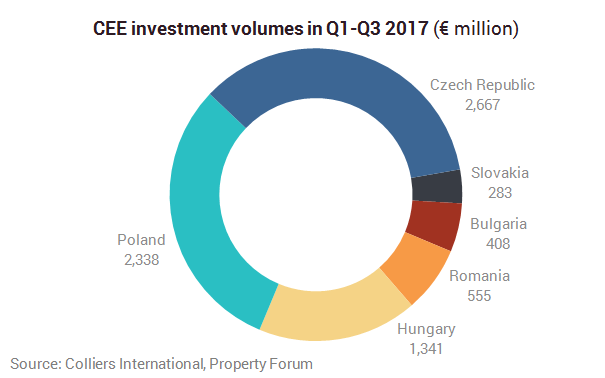

Investment flows into the CEE-6 region’s commercial real estate markets rose 12% y-o-y in the first nine months of 2017. The €7.6 billion closed deal total coupled with a still full pipeline of deals under consideration suggests that the annual cycle high of €12.2 billion invested last year is likely to be matched or overhauled. Substantial growth in Czech and Bulgarian volumes were the drivers of the momentum in the January-September 2017 period, says Colliers International in its latest report.

Total investment volume in the CEE-6 countries reached €2.2 billion in Q3 2017. Substantial growth in Czech (+71% year-on-year) and Bulgarian (+158% y-o-y) volumes were the drivers of the momentum in the January-September 2017 period.