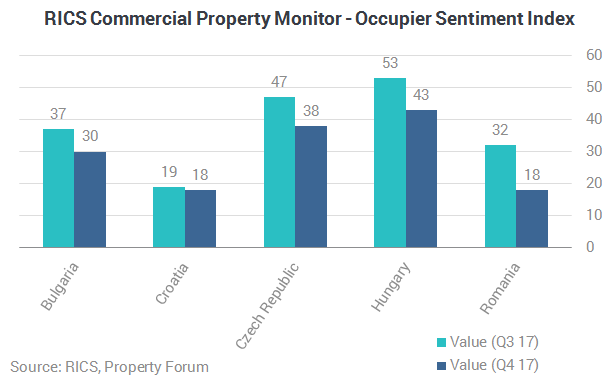

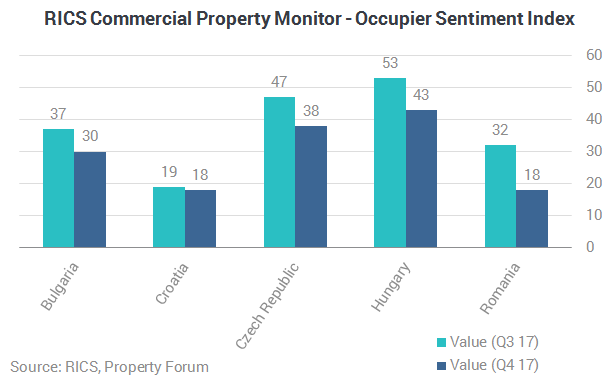

Hungary still leads the way on the occupier market

In Q4 2017 the RICS Occupier Sentiment Index (an overall measure of occupier market momentum) decreased noticeably in Bulgaria, the Czech Republic, Hungary and Romania, while it remained virtually unchanged in Croatia. Still, the index stands in the comfortably positive territory across all CEE countries tracked within the RICS Commercial Property Monitor.

Occupier demand continued to rise steadily across all sectors in all five countries. For several quarters in a row Hungary has posted the strongest reading in the region. In Bulgaria, relative to the previous quarter, demand growth remained firm in the office and retail sectors but eased slightly for industrial space. In Croatia demand growth rose at a similar pace across all market segments. In the Czech Republic demand growth decelerated somewhat across the office and industrial areas of the market. In Hungary the pace of growth remained broadly unchanged compared to Q3 2017, while in Romania it moderated.

“If we examine the commercial real estate trends in the CEE region for the past 10 years, it is clearly visible that Hungary is currently playing catch up with the other CEE countries (especially Poland and the Czech Republic) and the last quarter of 2017 is a great example of this phenomenon. While there was considerable investment volume and occupier demand in those countries during the recession, Hungary has reached a sleeping status, and when global economic rise has brought national and international money into the region, this gap has made all Hungarian real estate sectors (office, retail, logistics, hotel) attractive with its relatively high yields and value add opportunities. Many transactions on the investment side and also on the occupier side have been finalized by the end of the year making the investment volume c. €2 billion (only 2007 had a better result) and a historically low 7.5% vacancy rate on the Budapest office market. These KPIs had a faster growing trend compared to the other CEE countries. It is also interesting to see that the type of investors has been diversified compared to the previous cycle: while in 2007 it was mainly western institutional funds investing in Hungary, now local funds and private equities as well as Chinese, Oriental and South African equity is playing an active role. The present is positive but the speed of this sentiment is expected to slow down when the 500,000+ sqm new office stock hits the Budapest office market by the end of 2019 and the landlord market will turn back to an occupier one once again,” comments

Mátyás Gereben MRICS, Country Manager for Hungary at CPI Property Group,

Looking at supply, availability continued to decline in the Hungarian retail sector and was flat in other segments of the market. In Romania availability continued to rise at a slightly slower pace relative to Q3 2017, whereas in Bulgaria, Croatia and the Czech Republic availability declined across the board.

“I do not expect the year 2018 to significantly differ from the previous one. We continue to follow positive market trends in logistics. We expect more multi-storey facilities in Europe, but only at locations with high land prices. As the sector grows and technology enables users to have a more agile supply chain, the time needed to bring goods to customers becomes the value driver in supply chains. The Czech Republic is becoming increasingly established among the developed markets, similar to Western Europe. The customers are more demanding and appreciate above-standard services. Both the price and the value of real estate is growing,” adds

Martin Polák, Senior Vice President, Regional Head at Prologis CEE.

Strong occupier demand has led to 12-month rental expectations being revised up compared to the last quarter in Bulgaria and Croatia. Once again, the prime sectors are expected to significantly outpace their secondary counterparts, In the Czech Republic, Hungary and Romania rental expectations for the next 12 months came in below the previous quarter’s projections. Still, further rental growth is expected for all segments of these three markets.

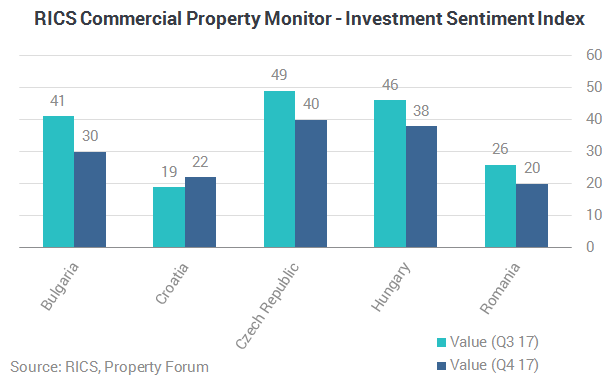

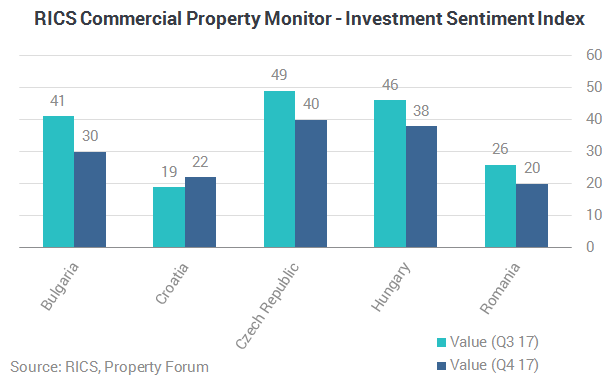

Investors most confident in the Czech Republic

With the exception of Croatia, where the value of the RICS Investment Sentiment Index (an overall measure of investment market) increased slightly, all other CEE countries saw a small drop. Still, the index reflects a solid momentum behind the regional investment market.

In all five countries investment enquiries increased across all three sectors, with robust demand growth for Czech and Romanian offices, industrial leading the way in Bulgaria and the office and retail sectors displaying the firmest results in Croatia. In Hungary the pace of growth at the all-sector level moderated from the previous quarter. Respondents also noted growing interest from foreign investors in all CEE countries surveyed by the RICS.

“After long period of illiquidity the Croatian market is recovering. The NPL transactions of last 18 months brought new players as well as new capital on the market and gave banks the chance to stabilise their balance sheets. Retail investments on the market are in downturn as high saturation has been achieved in A and B cities. C cities with under 10,000 inhabitants but with a gravitation pool of up to 20,000, mostly in the rural parts of Croatia offer significant investment opportunities through smaller retail park schemes. Tourism and hotels are a stable investment part although the VAT changes as well as possible changes in communal fee could pose as a wind down factor for some larger schemes. Logistics in Croatia is a neglected sector. There is only one commercial logistic park and four in house logistic parks of retailers. As Croatia is located on an important transit route between Middle Asia and the EU with superb direct connections and harbour infrastructure, the potential for logistic parks developments is significant and is one of the largest investment potentials of Croatia for the next ten years,” comments Denis Cupic MRICS, Managing Partner at F.O. Development.

Capital value projections for the coming year rose in Bulgaria, Croatia and the Czech Republic, with growth expected across both prime and secondary markets. In Hungary and Romania 12-month capital value expectations were revised down across all areas of the market from Q3 2017. Nevertheless, respondents still envisage all sub-markets to see post positive capital value gains in the coming year with prime offices leading the way.

In most CEE countries the majority of contributors feel that the market offers fair value at present. It is worth to note, however, that the share of those who see the market as expensive increased in Bulgaria, the Czech Republic and Hungary. In Croatia, however, a notable 23% sense the market is undervalued at present. A large share of respondents in Romania also feels that the market is undervalued.

In most CEE countries the largest share of respondents believes that market conditions are consistent with the early to middle stages of an upturn. However, in the Czech Republic the majority (68%) believes that the market is close to peaking, whereas the same figure for Hungary strands at around 20%.

Just like in Q3 2017, credit conditions improved further in three of the five countries. In the Czech Republic credit conditions deteriorated marginally over the quarter, while in Romania credit conditions reportedly improved very modestly in the fourth quarter.