After the record-breaking year of 2017, the student housing asset class still enjoys development and increased interest from investors. Michal Malecka, Head of Business Development at StudentMarketing talked to Property Forum about the growing popularity of the student housing asset class in Europe.

Michal Malecka will give a presentation about the European student housing market at the upcoming CEE Property Forum 2018 in Vienna.

How has the student housing asset class performed on the European investment market so far in 2018?

After the record-breaking year of 2017, the asset class this year still enjoys development and increased interest from investors. Traditional asset class players are looking to strengthen their existing stock as well as add new locations, e.g. by going to Tier 2 and 3 cities or to new regions such as CEE. Institutional investors are increasingly interested in establishing or buying their own portfolios. We also see more foreign capital flowing from outside of Europe, Southeast Asia in particular.

Would you say that student housing has become more popular among investors in CEE?

Investors are showing increasing interest for student housing in CEE. The overall positive economic situation in the whole real estate market of CEE adds to the attractiveness of student housing in the region. Moreover, investors prefer to utilise the benefits of CEE as a less saturated market. They are looking for higher returns where there will be enough space for their development prospects.

Michal Malecka

Head of Business Development

StudentMarketing

What types of investors are currently targeting student housing in the region? Where are they coming from?

Besides traditional asset class players establishing their presence in the market, it is also institutional investors who are increasingly interested in student housing in the region. Major global players who have been present in the asset class for decades discover less saturated European markets and enter CEE. Those investors are backed up by capital from Europe, U.S. as well as Southeast Asia. In terms of countries, Poland, Austria or the Czech Republic are definitely on the radar of both local as well as international investors coming to the region.

Which CEE cities attract the most capital?

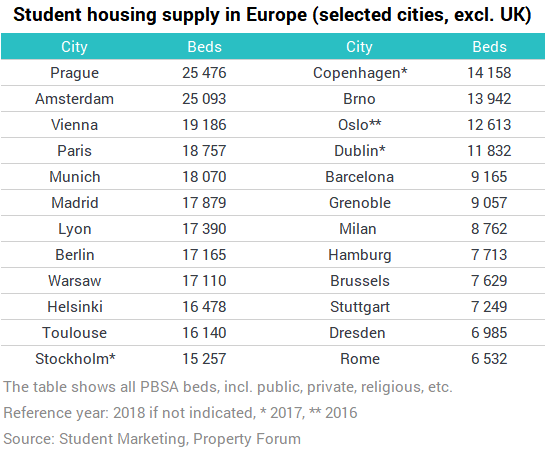

Cities with growing student demand and undersupply in terms of student beds attract the most capital. Some of the key factors for the investors to consider are the prospects of increasing number of students, a growing number of English-taught programmes as well as the low provision rate of purpose-built student accommodation (PBSA) beds per student. Major CEE cities follow this attractive pattern for investors.

Regarding the provision of private supply vs international student demand (excluding UK cities) Vienna is leading with 2% private supply vs international demand, followed by Warsaw (5%) and Prague (11%). Warsaw, Krakow, Wroclaw and Poznan are attractive markets with strong university representation and growth in both total and international student population. Prague, Budapest and Brno are among other interesting markets to look at.

Which CEE cities offer the best opportunities to developers right now? Which cities will see a growth in supply in the coming years?

Developers are mostly active in the Polish and Czech cities, namely Warsaw, Krakow or Prague. Vienna, with its low provision of private supply vs international student demand, is naturally enjoying a lot of interest from both local as well as international players, with over 1,500 beds currently in the pipeline.

Have the needs of students changed significantly in recent years? Are there any new details that developers now need to pay attention to?

One general trend spotted across the countries and cities is that the equipment of the room is less and less important while common areas are increasingly more important for students. The location is a standard no. 2 or 3 in terms of importance for them, but common areas like gym, games room, TV room, cafeteria or other premises that allow engagement and socializing are becoming a must these days.