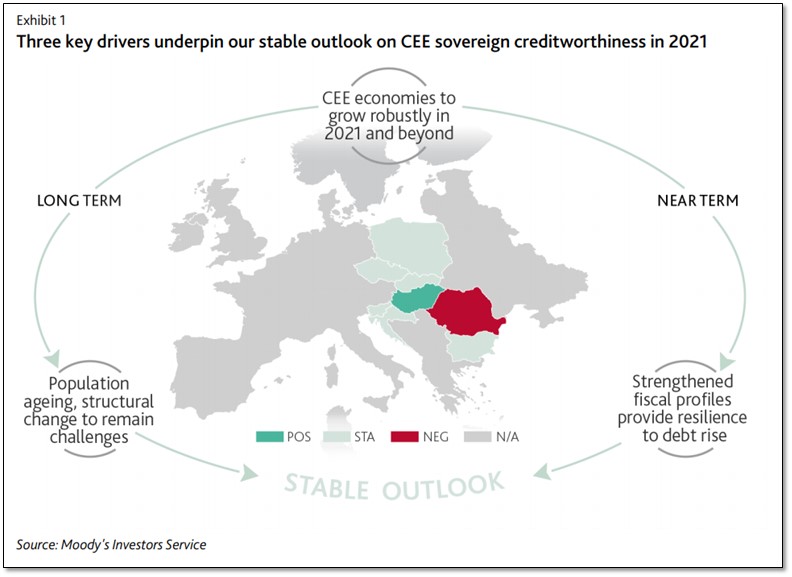

The stable 2021 outlook for sovereigns in Central and Eastern Europe (CEE) reflects their robust economic growth prospects and strengthened ability to carry and reduce debt, which make their credit profiles resilient to the sharp deterioration of their public finances in 2020, Moody's Investors Service said in a report published today. Ageing populations and structural economic change will remain longer-term challenges for the region.

CEE economies are forecast to grow by 4.1% in 2021 as they recover from a severe 5.1% contraction in 2020. Beyond 2021, CEE growth is expected to be more robust and resilient to the impact of the pandemic than that of most euro area peers. Lower exposure to tourism, greater reliance on industry and manufacturing and an increase in EU funding under the bloc's recovery fund are some of the factors supporting the robust growth outlook.

"Despite debt and deficits sharply rising across Central and Eastern Europe in 2021, increases in governments' ability to carry and reduce debt and the region's robust medium-term growth prospects will support the resilience of their credit profiles," says Petter Bryman, Assistant Vice President – Analyst at Moody's Investors Service. "That said, the evolution of the underlying public health crisis triggered by the pandemic remains uncertain, despite the roll-out of mass vaccination programmes, and continues to pose risks for the region's economic outlook in 2021. A weaker-than-expected rebound or renewed recession would hurt public finances and otherwise resilient banks, and could potentially create political strains."

Over the longer term, CEE economies still face structural hurdles to economic growth and long-term economic development, most notably due to rapid population ageing. This poses a number of challenges to economic strength and fiscal sustainability, that will become increasingly prominent over the 2020s and beyond. However, the immediate symptoms, such as labour shortages and deteriorating cost competitiveness, will be less prominent in 2021 as CEE economies emerge from the pandemic.