Vacancy rates reached a record low level on the Budapest office market as a result of modest development activity and strong demand from tenants. The Budapest Research Forum has published its quarterly office market analysis.

One new speculative office building was delivered to the market in the second quarter of 2016 extending to 5,700 sqm in the CBD, whereas one office building (3,490 sqm) was excluded from the stock, as it was sold and is expected to change its function in the near future. The total modern office stock is currently 3,297,360 sqm. The total modern office stock comprises 2,632,780 sqm of Category ‘A’ and ‘B’ speculative, and 664,580 sqm of owner occupied buildings.

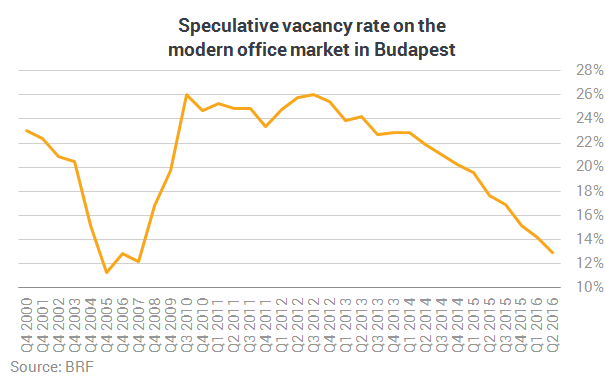

The office vacancy rate continued to decline further by 3.9 pps year-on-year and 1.0 pps quarter-on-quarter bottoming at 10.3%, the lowest level since the financial crises. The lowest vacancy rate (5.8%) was measured in South Buda submarket, whereas the Periphery region suffered from a 31.2% vacancy rate. The vacancy rate of the Non-Central Pest submarket improved the most by 8.1 pps y-o-y standing at 7.9% at the end of Q2 2016.

In terms of submarkets, Váci Corridor had the highest leasing activity, as 30.1% of all transactions were signed there. This was followed by Central Pest and Central Buda, with a share of 25.2% and 13.2% within the total leasing activity.

Net absorption totalled 36,526 sqm in Q2 2016, 24.7% higher than in the previous quarter. Out of this volume, Central Pest accounted for 14,933 sqm.

The Budapest Research Forum (BRF) comprises of CBRE, Colliers International, Cushman & Wakefield, Eston International, JLL and Robertson Hungary.