The significant increase in interest from international investors looking for the best formats of cooperation with local developers sends a powerful message to the market in Romania’s capital city. Importantly, the abovementioned interest applies not only to the office sector, but also to the retail and logistics ones.

The first half of the year saw a considerable drop in the office vacancy rate from approx. 13% at the end of 2016 to approx. 9% at the end of the first half of 2017, which was the result of steadily rising demand.

“The Bucharest office market shows enormous potential and current high level of take-up is confirming it. The first half of the year ended with a record volume of leases signed, i.e. 157,000 sqm, which was approx. 7,000 sqm more than recorded for the corresponding period last year. Occupiers have a large appetite for brand new Class A office buildings. This year, many new office schemes will be fully leased before completion”, commented Louis-Maxime Juhel, Office Agency Director at BNP Real Estate Romania.

Despite delivery of new Class A office buildings, it is estimated that over the coming quarters the high level of demand for prime schemes may lead to a drop in office vacancy rate to below 7-8%. The office market will then slowly transform itself into a distinct landlord market.

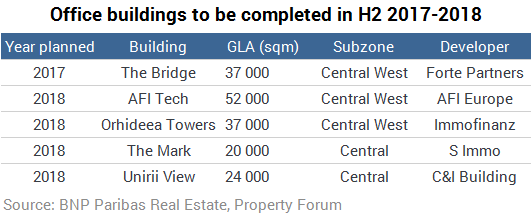

When analysing the capital city’s office market, it becomes noticeable that the obvious workhorses here are the areas located in the north of Bucharest. Barbu Vacarescu-Aurel Vlaicu and Dimitrie Pompei attracted the majority of tenants as they offer a good balance between the standard of the space available and total occupation costs. Analysts estimate that the pattern of market development will change over the next 2-3 years due to the 200,000 sqm to be delivered in the central west part of the city (Grozavesti – Politehnica).