Getting a clearer picture of market participants’ expectations is more important than ever in these turbulent times. That’s why Property Forum and RICS launched a survey on the potential implications of the COVID-19 crisis on real estate markets in CEE. Nearly 100 people filled out our questionnaire. Here are the results.

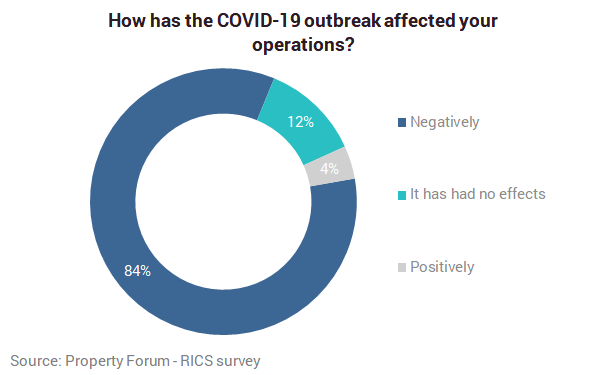

The overwhelming majority is negatively affected by COVID-19

First, we asked respondents to share how the COVID-19 outbreak affected their operations. The overwhelming majority reported a negative effect, some view themselves as unaffected and 4% of respondents claim to have been positively impacted.

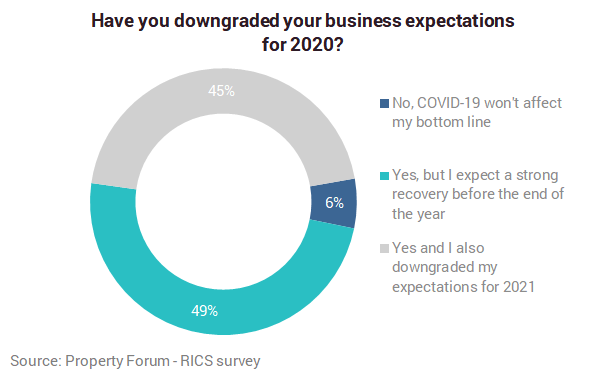

Bottom lines won’t be unaffected

Only 6% of respondents believe that their bottom line won’t be affected by the coronavirus crisis. Roughly half of the remaining respondents expect a strong recovery before the end of the year while the other half expect negative financial consequences for next year.

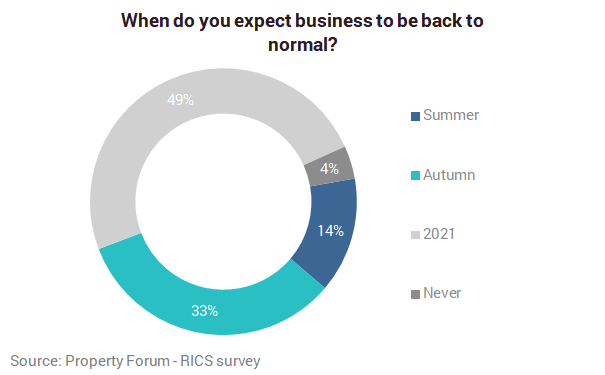

Things probably won’t go back to normal this year

Nearly half of respondents expect business to be back to normal only 2021. Significantly fewer people except a normalization in the autumn and even less in the summer. Nobody expects business to be back to normal in May or earlier. 4% of respondents expect things to never go back to normal.

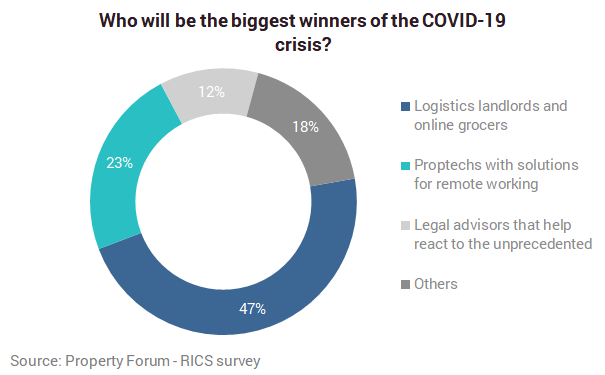

Logistics landlords and online grocers could benefit from the lockdowns

The COVID-19 crisis is clearly bringing new business opportunities for certain market players. Respondents expect logistics landlords and online grocers to benefit most from the lockdowns, followed by proptechs that offer solutions for remote working and legal advisors that can help clients react to the unprecedented. Additional responses included office developers that continue the construction of new projects, flexible space operators and opportunistic investors. Two respondents added that we shouldn’t be thinking about “winners” at this time.

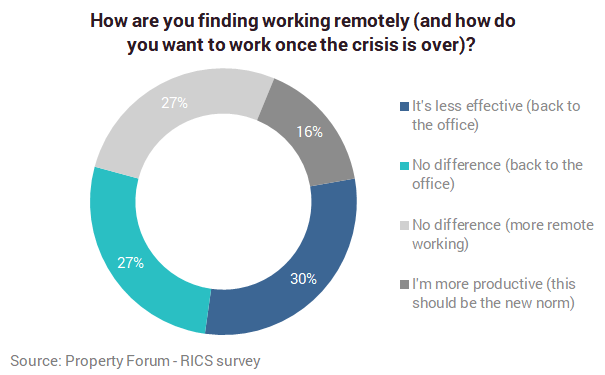

Market players are split on the efficiency of remote working

Every single of our respondents is currently working from home. The majority of them (57%) wants to go back to the office once the crisis is over, while the remaining (43%) would prefer more remote working opportunities. In terms of efficiency, 30% reported a decrease in efficiency while 16% found themselves more productive in the home office. For the majority (54%), working from home doesn’t seem different from working in the office.

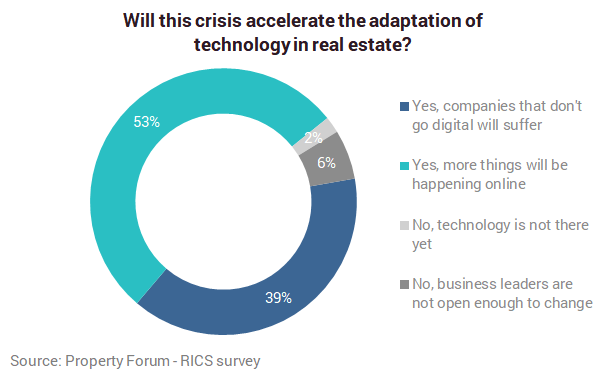

This crisis will accelerate the adaptation of technology

The overwhelming majority (92%) believes that the COVID-19 crisis will accelerate the adaptation of technology. The remaining 8% thinks that technology is not there yet or that business leaders are not open enough to change.

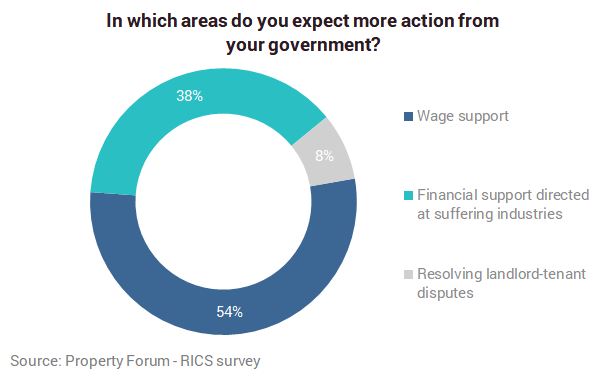

Mixed ideas on what governments should do

When asked in which areas governments should take more action, the majority of respondents ranked helping the unemployed and employers struggling to pay wages with the highest priority. Financial support directed at suffering industries is expected by one-third of respondents, while only 8% clicked on resolving landlord-tenant disputes. Other suggestions included investing in making every business process digital, providing solutions for banks to keep financing new projects and investing in healthcare.

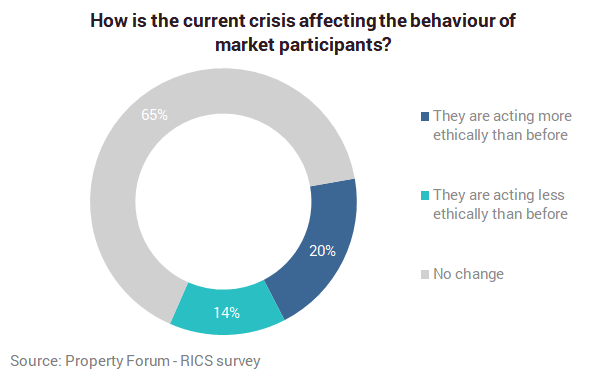

The crisis doesn’t really affect ethical behaviour

Almost two-thirds of respondents have not experienced any change in the ethical behaviour of market participants. That said, the share of those that have experienced a change in the position direction is larger than of those that observed a change in the negative direction.

Uncertainty is a major issue

In an open-ended question, we asked respondents to share their main challenges in running their business. These were the responses:

- 21% mentioned problems caused by the sudden transition to home office. Not being able to inspect properties in person and have face-to-face meetings are amongst the biggest advantages of working from home.

- 21% mentioned tenants not being able to pay rents, asking for discounts/deferments as a major issue. Some think this will also have a negative impact on valuations, liquidity and transparency.

- 21% mentioned uncertainty and the lack of predictability as a huge problem.

- 19% finds it difficult to operate with falling revenues and struggles to keep the business alive while trying to manage without firing people.

- 18% mentioned cash flow issues as a major problem.

- 18% mentioned being in a difficult situation because everyone is in waiting mode. This affects ongoing and new transactions, as well as the availability of financing.

- 5% finds the whole situation too hectic. There are too many and frequently changing orders and requests from governments, clients and business partners.

Who filled out the survey?

Our 98 respondents come from a diverse background. In terms of location, almost two-thirds of them (64%) are based in one of the V4 countries – Hungary (20%), the Czech Republic (19%), Poland (17%) and Slovakia (7%), followed by Romania (9%) and the SEE region (14%). The remaining responses came from people based in other countries (mostly Austria). In terms of business activity, advisors (25%), investors (24%) and developers (20%) made up almost three-quarters of respondents, followed by bankers (14%) and other real estate professionals (18%).