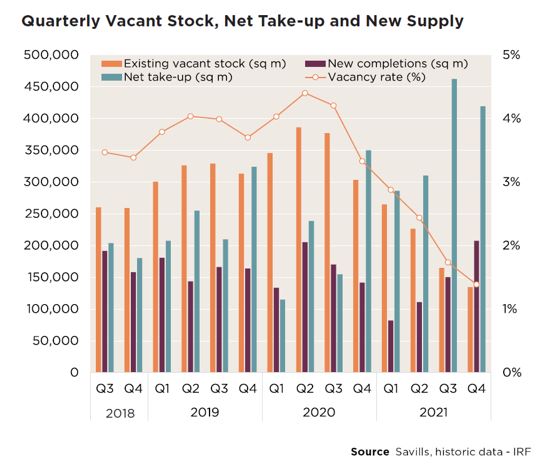

According to Savills latest report, 2021 was the best year on record for the Czech industrial market in terms of tenancy activity, despite the low volume of new completions and extremely low vacancy rate. Gross take-up totalled a staggering 2.32 million sqm, being 53% higher than the previous record of 1.55 million sqm seen in 2020. Annual net take-up (excl. renewals) reached 1.48 million sqm, a 46% increase over the former record of 1.01 million sqm registered in 2017, Savills reports.

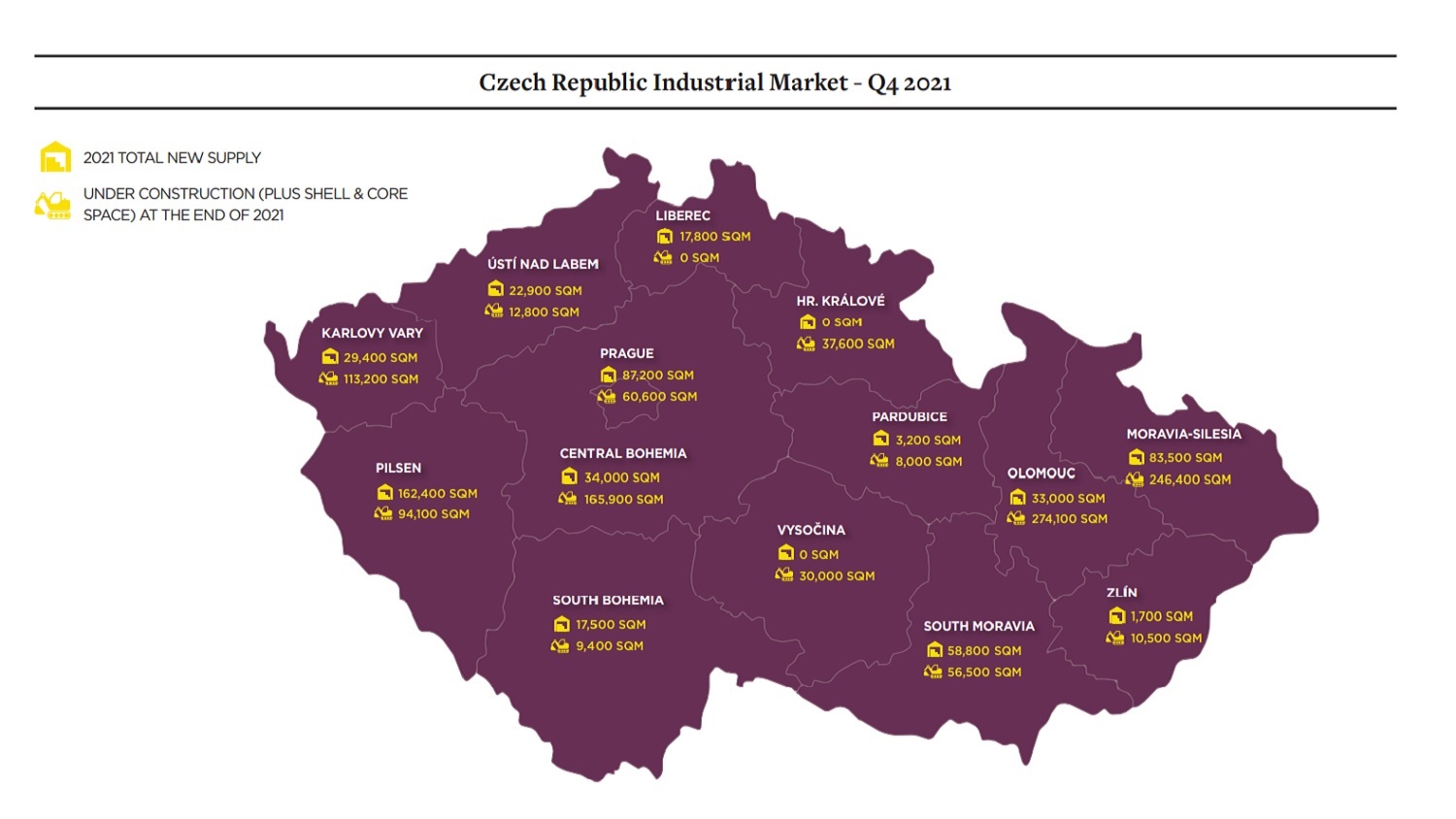

The total national stock of modern industrial space intended for lease reached 9.7 million sqm. Of that 551,100 sqm was added to the market during the year, being the lowest annual new supply since 2014. Without any significant shift seen in the past few years, 34% of the total national industrial inventory is found in Prague, mostly around the Prague Outer ring-road. The Pilsen region is the second most developed submarket in the country, accounting for 15% of the nationwide stock, and the region of South Moravia ranks third with a share of 12%.

Lenka Pechová, Senior Research Analyst, Savills CZ&SK, comments: “With a record volume of space under construction or in shell & core finish across the country exceeding 1.11 million sqm, the volume of completions shall pick-up in 2022. At the end of 2021, construction was underway at 50 industrial parks across 13 regions. The construction pipeline has grown to 1.12 million sqm, while the majority of that space was under construction in the Moravia-Silesia region (24%), Olomouc region (22%) and Central Bohemia (15%). The already densely developed Prague submarket was facing critical land constraints as only 60,600 sqm of space was under construction. The volume of speculative construction totalled 311,300 sqm, again with the largest

share located in the regional market of Moravia-Silesia.”

At the end of 2021, the nationwide vacancy rate dipped to a new all-time low of 1.4%, having fallen by 194 basis points (bps) from the beginning of 2021. The regional breakdown revealed that 13 regions (of all 14) posted a vacancy lower than 3% in December 2021, while in ten of them the share of unoccupied existing space even equalled zero or less than 1%. With a vacancy at 0.9%, Prague is effectively out of available space and with very limited development potential, the capital’s annual net take-up only came to 193,700 sqm, the lowest since 2012.

Space to produce, store and distribute goods continued to be in high demand as companies race to keep up with consumption. Fourth-quarter gross take-up in the Czech Republic amounted to 609,800 sqm, the second-highest in the market's history and also 14% up compared to the previous quarter as well as y-o-y. Lease renewals represented 31%.

Similarly, Q4 net take-up volumes also saw the second-best performance in the history of the Czech industrial market, with lease commitments signed for a total area of 419,300 sqm. The share of pre-leases remained high, at 60% of the Q4 net take-up. Leases of less than 10,000 sqm dominated net demand, accounting for 85% of the Q4 transaction count.

Chris LaRue, Head of the Industrial Agency, Savills CZ&SK, adds: “Czech industrial market continues to experience strong demand in a limited supply environment, resulting in a very challenging situation for tenants from both availability and cost perspectives. Rising fuel, energy and construction costs coupled with labour shortages are additional factors through which industrial occupiers are having to navigate. In addition to that, at the end of February, the manufacturing, logistics and construction sectors have been impacted by Russia's invasion of Ukraine, which is still ongoing. We do not only see an outflow of workers as some return back to Ukraine to defend their country but at the same time companies are experiencing disruption of business and supply chains as many occupiers based in industrial parks in the Czech Republic have clients and suppliers in Ukraine. Simultaneously, companies are pulling out of Russia, in some cases also from Belarus and, in the future, we may also see a higher number of companies reshoring from China. On the other hand, the Czech labour market may benefit from the influx of women from Ukraine.”