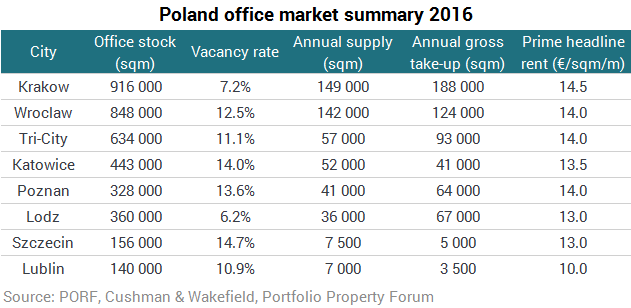

In 2016, total office stock in Poland’s eight key regional cities (Krakow, Wrocław, Tricity, Katowice, Poznań, Łódź, Szczecin and Lublin) rose to nearly 4 million sqm. Krakow, Wrocław and Tricity remain the largest regional office hubs. Office take-up hit nearly 590,000 sqm, which represented a 50% rise on the average for the years 2011–2015. Cushman & Wakefield presented an overview of the Polish regional office market for 2016 in its latest report.

The total volume of lease transactions completed on the Polish regional markets in 2016 reached 585,000 sqm. The strongest leasing activity was in Krakow (188,000 sqm) and Wrocław (120,000 sqm). At year-end 2016, net absorption was positive and totalled approximately 380,000 sqm, up by 9% on 2015’s value.

Krzysztof Misiak, Partner, Head of Regional Cities, Cushman & Wakefield, said: “Regional office markets are witnessing rapid growth and very strong occupier interest, with the highest demand recorded in Krakow, Wrocław and Tricity. Leasing activity is also robust in Łódź, Poznań and Katowice, whilst other regional markets with a significant growth potential include Lublin and Szczecin. Business services are the main driving force behind the growth of the regional markets. This sector employs more than 200,000 staff in nearly 1,000 business services companies operating across the country. Poland remains an attractive place to locate business, especially in the tech and financial sectors.”

Kamila Wykrota, Partner, Head of Consulting & Research, Cushman & Wakefield, said: “Strong demand levels are leading to increased developer activity in regional cities. Given the development pipeline, this year’s supply is expected to be close to the record high posted in 2016. The largest volume of new office space is likely to be delivered in Krakow, which will see its total stock top 1 million sqm this year.”

Robust developer activity pushed the average vacancy rate up by 1.7 percentage points to 10.8%. The vacancy rates rose in Wrocław (from 8% to 12.5%) and in Krakow (from 3.7% to 7.2%), and fell in Łódź (down to 6.2%) and Poznań (13.6%). Rents remained flat at €12–14.5/sqm/month in the largest regional cities with the highest asking rents in Krakow, Wrocław and Tricity.

Katarzyna Lipka, report author and Associate Director, Consulting & Research, Cushman & Wakefield, said: “Given the large volume of office space under construction on most regional markets, both developers and owners are likely to see growing tenant expectations and will be challenged to offer more lease incentives. Poorer quality office buildings or those located in secondary locations will be most affected.”