Take-up on the Bratislava office market amounted to 26,000 sqm in Q1 2020 which represents a 58% decrease compared to Q4 2019. The Bratislava Research Forum (JLL, CBRE, Cushman & Wakefield and Colliers International) published the office market figures for Q1 2020.

Stock

In the first quarter of 2020, the total office stock of Class A and B quality in Bratislava amounted to more than 1.83 million square meters. 62% of the space is represented by Class A premises and 38% by Class B office space.

There were no new buildings completed in the first months of 2020, ten office buildings are still under construction with planned completions in 2020/2021 and adding approx. 130,000 sqm of new leasable area in the Bratislava office market.

New methodology

In 2020, Bratislava Research Forum (BRF) agreed to a new methodical approach, which makes BRF market survey more specific and more accurate. First of the changes comparing to the previous years is different market zonation which reflects on the ongoing construction of a new Central Business District (CBD) and several new projects within Bratislava. With this new zonation, Bratislava copies trend of foreign metropolises which makes the city more transparent also for the foreign investors.

Comparing to other zones, the newly emerging City Business District (CBD) is in terms of area the smallest one, but with its offer of square meters of modern offices, it ranks second with a 26% share of a total office stock of the Slovak capital.

Another innovation is excluding government administrative buildings and owner-occupied buildings from the total office stock. Those buildings don’t offer premises for commercial use and they are owned and fully occupied by the same entity. Based on this change, the Bratislava commercial stock represents approximately 1.5 million sqm.

Out of the total office stock, 32 buildings (representing more than 621,000 sqm or approx. 34% of the total stock) have secured certification as green/sustainable developments – with either LEED or BREEAM ratings.

Transactions

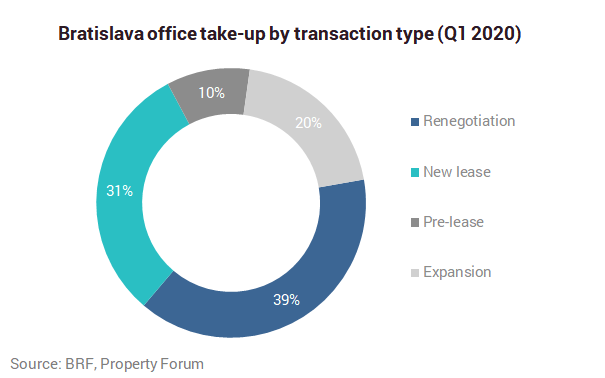

Transactions that have been concluded in the first quarter of 2020 amounted to almost 26,000 sqm, which represents a 58% decrease of the let area compared to Q4 2019. Renegotiations represented 39% of all transactions, new leases 31%, pre-leases 10%, and take-up share of 20% was attributed to expansions.

There were three leasing transaction larger than 2,000 sqm (one renegotiation, one expansion and one pre-lease) with individual sizes reaching 6,350 sqm, 3,000 sqm and 2,200 sqm. Additionally, BRF report another eleven transactions with the area of over 500 sqm. The majority of leased spaces in this quarter were let to the financial services sector (40%) followed by the IT sector (21%) and professional services sector (10%).

Vacancy and rents

The overall vacancy rate in Bratislava decreased in the first quarter of 2020 to 8.59% from 8.73% in the previous quarter. The lowest vacancy rate was recorded in South bank SB (3.11%), followed by Inner City IC (6.07%), City Center CC (8.03%) and CBD (9.21%). The highest vacancy rate was recorded in Outer City OC, reaching 29.55%.

The prime rent remained unchanged at €17.00/sqm/month.