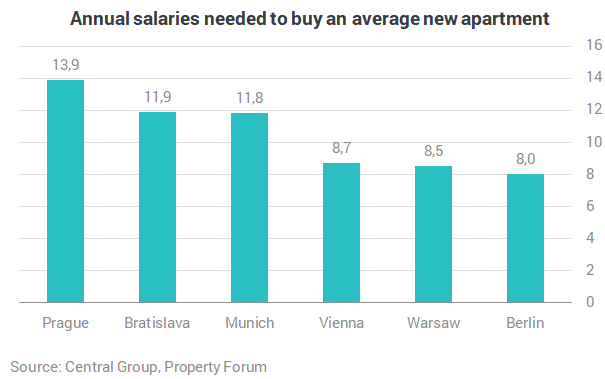

The availability of housing in Prague has slightly improved this year, but it is still incomparably worse than in the surrounding metropolises. The inhabitants of Prague have to work 13.9 years for an average 70 sqm apartment. In Vienna, for example, such a purchase only cost 8.7 annual salaries. Compared to last year, a slight improvement was registered in 2020, but the effect of the coronavirus crisis has not yet been reflected in wage statistics, according to Czech residential developer Central Group.

The Housing Affordability Index is an indicator that shows the number of average annual gross wages needed to buy an average 70 sqm apartment. The average gross monthly wage in Prague is CZK 48,035 (€1,813), while the price of an average new 70 sqm apartment is CZK 8,003,414 (€302,153). The index works with data from the Information System on Average Earnings of the Ministry of Labour and Social Affairs and is based on prices resulting from a joint analysis of Central Group, Trigema and Skanska Reality. It shows far more accurately than other statistics the situation directly related to Prague, where the income and housing situation is completely different than in the rest of the Czech Republic.

The main problem is the slow permitting of new apartments

The average Prague resident would spend 13.9 times their annual gross salary on a new 70 sqm apartment in the city. Thanks to faster wage growth (+ 4.5%) compared to house prices (+ 2.1%), this is a slight improvement to 2019 when the Index stood at 14.1. Six years ago, however, four annual gross wages were enough for the same apartment.

In comparison with the metropolises in the surrounding countries, the availability of housing in Prague has long been by far the worst. "In Munich, less than 12 annual wages are enough to buy an average new apartment, in Vienna only less than 9 are required. There, new construction is being allowed much faster than in our country. In Munich or Vienna, two to three times as many flats per thousand inhabitants receive building permits than in Prague and that has long been the case,” says Dušan Kunovský, Founder and Head of Central Group.

Apartment prices in Prague have risen by 96% since 2015

The lack of affordability is related not only to slow permitting but also to large increases in the cost of construction works, materials and land. As a result, since 2015, sales prices of new apartments in the capital have almost doubled. "While at the beginning of 2015 the average selling price of new flats in Prague was around CZK 56,000 per sqm, now it is over CZK 110,000. We expect that the prices of new flats will rise only in lower percentage units this year and should stagnate next year," adds Kunovský.

COVID-19 has brought changes to the housing market

The price level of new flats will be stable due to the persistent shortage of new offer. Partial reductions can only occur for overpriced projects in unfavourable locations or other unsuccessful attempts by less experienced developers. There is still a shortage of new flats in Prague.

"Last year, for the first time in a long time, over 5,000 flats in apartment buildings were permitted, but the need is at least double of that. In addition, the number of permits has dropped dramatically again this year. However, in order to reduce prices, construction work and land prices would have to become cheaper in addition to speeding up permits. And neither is happening yet,” Kunovský describes the situation on the market.

However, the effect of coronavirus is evident in the structure of demand. There has been a significant decrease in foreign buyers and also purchases of flats for the purpose of their short-term lease in the wider centre of Prague. On the other hand, the number of buyers who are looking for a safe investment in uncertain times and want to save their savings profitably and protect them from possible higher inflation and the devaluation of the Czech koruna has also increased.

Another visible change on the demand side is the increase in the number of clients who finance the apartment with a mortgage. These are significantly more affordable this year than before. This year, the CNB relaxed the limits on the provision of mortgage loans and interest rates have been falling for the seventh month in a row. The current average mortgage interest rate is only 2.02% per annum.