According to the forecast of EECFA, the Romanian construction industry is poised to grow in both 2022 and 2023. The main drivers of growth vary, including low interest rates and excess liquidity that boost the residential subsector or the use of EU 2014-2020 cohesion funds to help boost civil engineering, writes Dr Sebastian Sipos-Gug from Ebuild srl / EECFA Romania.

At the same time, the pandemic and the responses to it negatively impact construction, mainly in terms of hotel and restaurant construction, but also when it comes to office buildings. The EU’s Recovery and Resilience Facility (RRF) is a potential source of funding that could help counter these negative effects and maintain Romania's construction sector on a positive growth rate for the near future. The PNRR's (Romania’s National Recovery and Resilience Plan) impact would be maximized by reaching the appropriate milestones and targets on time, and by using this program together with other financing sources, like the national budget or other sources of EU funding. If implemented fully, the Plan could have a positive impact across the entire construction sector.

What is the PNRR?

The National Recovery and Resilience Plan (Romanian abbreviation: PNRR) contains the projects and measures Romania aims to implement in order to benefit from the EU's Recovery and Resiliency Facility (RRF). The RRF is a temporary instrument used as a means to mitigate some of the pandemic's effects on the members’ economies and has a total funding budget of €723.8 billion (out of which €29.2 billion are available for Romania). The RRF sets minimum targets for climate spending (37%) and digital spending (20%), which Romania has pledged to exceed (41% and 21%, respectively). Romania's Recovery and Resilience Plan includes 171 measures (out of which 107 are investments) and has six pillars, mirroring those of the RRF.

How do the RRF and PNRR work?

Out of the total amount, Romania can receive €14.2 billion in grants and €14.9 billion in loans (this is 13.09% of 2019's GDP). A pre-financing payment of 13% of each financing source has been granted to Romania, with the remainder of the loans and grants arriving in up to 10 instalments, which are themselves conditioned on the achievement of the milestones agreed with the EU in the PNRR. These milestones include several legal, policy and administrative reforms, as well as the completion of investments on time. Thus, the amounts received could be delayed or even rejected if Romania fails to achieve its milestones and targets.

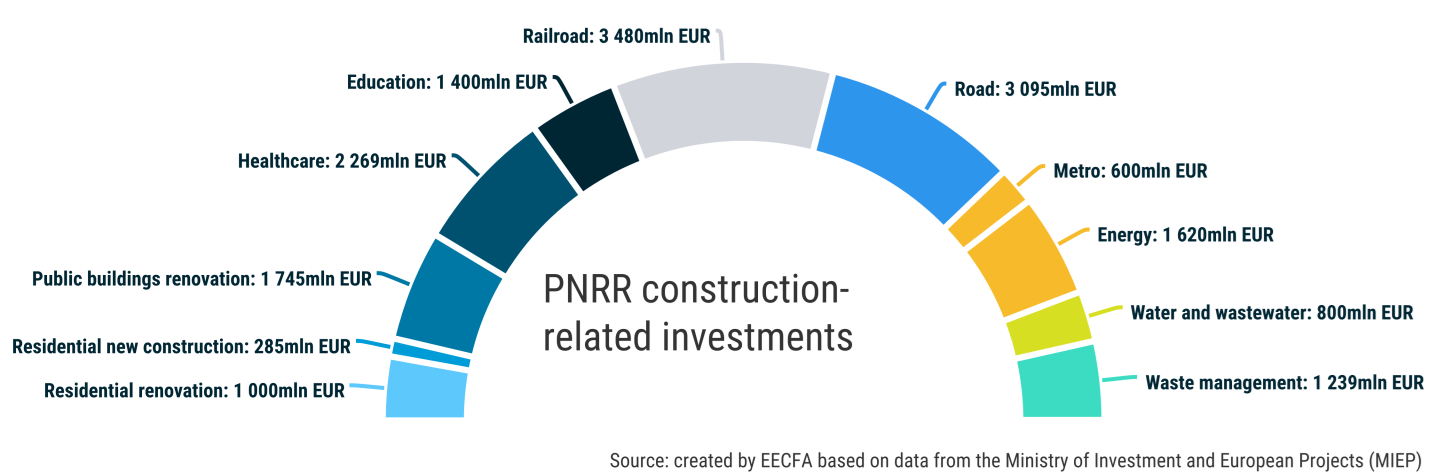

How will this impact the construction segments?

Residential construction

The PNRR has provisions for both new construction and renovation of dwellings. In terms of renovations, the plan has €1 billion allotted for improving the energy efficiency of around 4.3 million sqm of residential stock. To put this into context, in 2019, the entire residential renovation market in Romania totalled €800 million (source: NSI). This measure has a deadline of June 2026, and the first step is for the Romanian Government to create a national support scheme (by March 2022) and the local authorities will award the actual contracts.

Regarding new construction, 4418 new units will be built for the housing of young people from vulnerable communities and 1104 new units for teachers and healthcare professionals in areas where access to these services is lacking, such as villages and small towns. The assignment of contracts will again be tasked to local authorities, according to a grant scheme built on a national level. The program has a deadline of 2022 for the assignment of contracts and 2026 for the actual construction. The impact of this measure on the construction segment would be rather small, since, for comparison, in 2019 there were 67488 new residential units constructed across the country (source: NSI).

Non-residential construction

The PNRR should impact several types of non-residential construction, but mainly healthcare, education and public buildings. The total budget of investments in healthcare and education exceeds €4 billion if we include the equipment. For comparison, the total expenditure for the construction of healthcare, education and recreational buildings in 2019 was €284 million (source: NSI) so the impact of the PNRR here could be rather large.

The renovation of public buildings is also included in the plan with a target of 2.3 million sqm to be renovated with a focus on improving energy efficiency on a total budget of €1170 million and another 1.3 million sqm for moderate renovation (€575 million). For comparison, in 2019 the entire administrative building segment saw less than €266 million invested in renovation (source: NSI), so here, again, PNRR could help grow the construction segment.

Civil engineering

PNRR targets several civil engineering segments as well, with a focus on public utilities, transportation and energy.

In terms of public utilities, the water network would be expanded with 1600km and sewers with 2900km until mid-2026 on €800 million. For reference, in 2020, compared to the previous year, the networks increased by 1500km and 1898km, respectively, so this would in effect be comparable to the current yearly output in this segment. Another focal point is waste management with €1239 million allotted for various investments in waste collection, monitoring and recycling.

Sustainable transportation takes up more than a quarter of the total PNRR budget, with a €7.62 million allocation. This would include:

- €3.480 billion for railroad infrastructure - 2426km of rail renewals, 315km of modernized rail and 110km of electrified rail. For reference, in 2019 the value of railroad construction was €185 million (source: NSI).

- €3.095 billion for the construction of 429km of motorways (equivalent to the amount of new motorways completed between 2012 and 2020). The program will finance several segments on the A1, A3, A7 and A8 Motorways. For comparison, in 2019, €227 million were spent on motorway construction (source: NSI).

- €600 million for the metro networks in Bucharest (5.2km) and Cluj Napoca (7.5km).

- €620 million for green transport infrastructure - electric vehicle charging stations (52) and urban bicycle lanes (1091km).

In energy, the focus is also on renewable and green initiatives:

- €460 million for 3000MW of new wind and solar plants and developing battery storage facilities (480MWh). For comparison, the net generating capacity for wind and solar power across Romania in 2021 was 4273MW (source: Transelectrica), so this program would significantly increase production capacities.

- €515 million for renewable gas transportation, green hydrogen production and energy storage using hydrogen (1870km distribution pipeline).

- €300 million for methane production for electrical and central heating (1300MW).

- €280 million for battery and photovoltaic panel production and recycling (2GW worth of batteries /year).

The EECFA (Eastern European Construction Forecasting Association) conducts research on the construction markets of 8 Eastern-European countries.