Globalworth confirmed that is plans to raise approximately €300 million through a non‐pre-emptive placing of new ordinary shares. The funds would be used for new purchases in Poland (two office buildings) and Romania (three office building) with a total value of €410 million. The company also published its latest development plans.

The Board of Globalworth confirmed its intention on to proceed with an equity fundraising to raise approximately €300 million through a non‐pre-emptive placing of new ordinary shares, with the ability to increase this dependent on demand.

Assuming successful completion, the net proceeds of the placing will be used to fund a significant pipeline of attractive investment opportunities in both Poland and Romania, as well as for general corporate purposes. In addition, a key objective of the placing will be to attract new institutional investors and broaden the liquidity of the company's shares ahead of its planned move to the Main Market of the London Stock Exchange in 2018.

The company announced on 4 October 2017 that its subsidiary Globalworth Asset Managers SRL had entered into a conditional investment agreement to acquire a minimum of 50.01% and up to 67.90% of the issued share capital of Griffin Premium RE.. N.V., a Dutch entity listed on the Warsaw Stock Exchange. The Board of Globalworth expects investment to be completed on or around 6 December 2017. The acquisition of GPRE will be funded from the company's existing cash resources.

In addition to GPRE's previously announced contracted acquisition pipeline in Poland, the company reported a near term acquisition pipeline of five standing office properties under due diligence in both Poland (through GPRE) and Romania with an approximate aggregate investment value of €410 million. In Romania the pipeline includes three standing office assets with asset management potential. The three assets have a combined GLA of cca. 100,000 sqm, their combined value is around €250 million and the estimated yield is 8.5-9.0 percent. In Poland the pipeline includes two standing office assets with asset management potential. The two assets have a combined GLA of cca. 60,000 sqm, their combined value is around €160 million and the estimated yield is 8.0-8.5 percent.

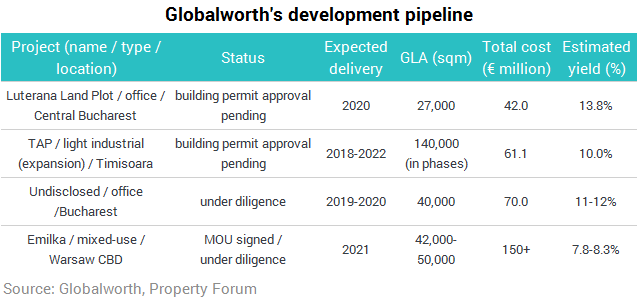

The company also announced that additional development projects are being prepared in connection with existing land plots it owns in Bucharest and Timisoara, and a further pipeline of new development projects under due diligence in Bucharest and, through GPRE, in Warsaw. These projects have the potential to deliver a total gross leasable area in excess of 250,000 sqm between 2018 and 2022.

- Growthpoint Properties Limited has agreed to subscribe in cash for such number of placing shares as would result in Growthpoint's and its associates' total direct or indirect shareholding following the placing increasing from approximately 27.0% to approximately 29.5% of the votes exercisable at a general meeting of the company on a fully diluted basis.

- Certain funds and accounts managed or advised by York Capital Management Global Advisors, LLC have agreed to subscribe for a portion of the placing shares equivalent to the percentage of the company's existing issued share capital owned by them (approximately 18.7%), subject to a maximum subscription of €30,000,000, and to their subscription being scaled back at the discretion of the company.

- Certain funds and/or accounts managed by Oak Hill Advisors (Europe), LLP and its affiliates have agreed to subscribe for placing shares with a value of €25,000,000.