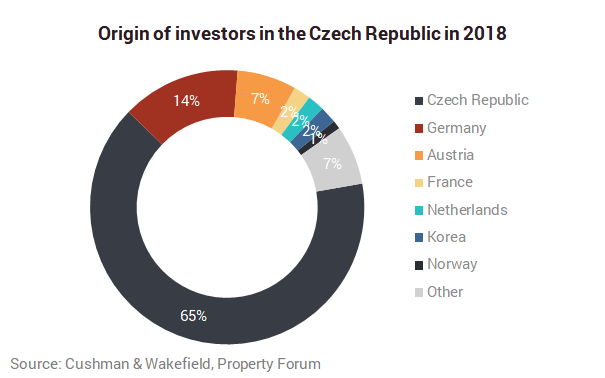

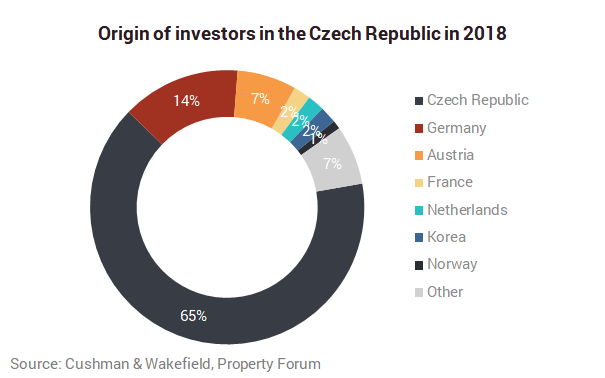

According to Cushman & Wakefield, the total amount invested in commercial real estate will exceed €2.8 billion in 2018 in the Czech Republic. The market has been the most active in the fourth quarter when approximately a half of the total annual volume of investments has been transacted. Czech investors have invested almost €2 billion, accounting for 65% of investments in the Czech Republic. Of the total investment volume, 60% has been invested in Prague and the rest in the regions. The year’s biggest transaction is the sale of CTP’s three industrial parks to Deka Immobilien, a leading German investor, for €460 million.

Cushman & Wakefield expects the market to remain highly active next year, with the value of the assets also growing. The greatest part of transactions in 2019 will be attributable to offices, with several major transactions being in the pipeline. In terms of capital structure, Asian capital will assert itself strongly alongside Czech and Western capital.

Compared with last year’s record, investments in commercial properties decreased by 20% this year, but transaction activity remained high and the investors’ demand grew. Czech investors invested twice as much as they did in 2017. The strong investment market in the field of commercial real estate is also supported by the record-breaking low vacancy rate of offices and storage facilities and growing shopping centre revenues.

“While the total volume of transactions completed in 2018 will decrease, this is not attributable to a lack of interest in commercial stock in the Czech Republic. By contrast, the market is very active and the interest of investors is not subsiding. The Czech Republic is becoming a mature international market, which is stable and sufficiently predictable for investors. The last two years were exceptionally generous with large transactions. A number of large portfolios were transacted over a relatively short time span, including CBRE GI and Letňany SC,” says Michal Soták, Head of the Capital Markets Team at Cushman Wakefield.

While retail dominated the investment market last year, offices have been the most commonly traded stock this year. Retail properties are currently held by long-term investors so they will not be on offer for other investors for some time. This is also why the number of major transactions was lower this year. The great demand for office stock in Prague is also reflected in prices. The yield, especially from offices and industrial products, keeps on decreasing, confirming the strong interest of investors and product appeal.

Czech investors have invested the highest amount of capital. They are strong particularly in the small and medium investment segment.

“Czech funds, whether distributed to individuals or to qualified investors, see a constant inflow of funds and, accordingly, they seek suitable properties to acquire. Hence, we see the demand on the part of the local capital increasing along with the target value of the investment. Even a medium-sized Czech fund is capable of purchasing a property worth CZK 1.5 billion in Prague today. Just a few years ago, the target was around CZK 500 million. Western investors are returning to the Czech Republic as well, with yields in Germany and France dropping below 3%. We will see capital from new Asian investors in 2019,” says Soták.

Aside from traditional local capital groups such as REICO, smaller investors are newly gathering as part of local funds and are capable of reaching bigger products together. The Karlín Palace is an example. This trend already appeared in 2007 and is coming back today.