Strong economic growth, booming tourism and increasing construction activity characterise one of the least well-known markets of the CEE/SEE region. Total office stock in the capital barely exceeds 100,000 sqm, which results in one of the highest rental fees in the region. The situation is, however, about to change as new mixed-use projects of higher quality should increase the pressure on landlords. Stela Dhami, Managing Partner at Colliers International shared us her positive outlook on the Albanian market.

What are the main trends driving the Tirana office market? Which sectors are tenants coming from?

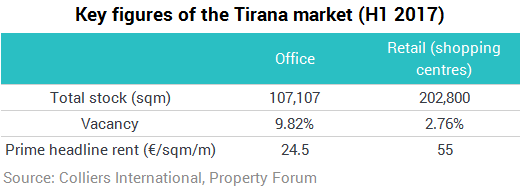

The office market in Tirana continues to be dynamic with demand being driven by international companies expanding their activities in Albania and local companies moving their activity from converted office space into office buildings. The BPO sector has been of particular interest in the past five years with growth coming particularly from Italian companies. They choose Albania for its geographic proximity to Italy, skilled labour force particularly in terms of foreign languages and for overall lower operational costs. A new wave of construction permits that were issued this past year will increase the office stock dramatically, which should additionally increase the downward pressure on prices. At present the office stock in Tirana stands at 107,000 sqm. There is definitely more room for growth in this sector to house buildings that bring the right balance between quality and price. The office buildings that will perform better are the ones that are professionally managed and that offer a good business environment to their clients.

We predict that most of the mixed-use buildings that are foreseen to enter the market in the upcoming 3-5 years, will affect the market dramatically by increasing the quality of the office stock as well as the pressure on landlords in terms of prices. Tirana to date holds some of the most expensive rental rates in the region and tenants have limited choice for quality premises.

What sort of changes has the Albanian retail market seen in 2017? Are there many new developments in the pipeline?

The Albanian retail market has reached a point of maturity and stands at 202,800 sqm. Toptani shopping centre opened in 2017 thus further increasing the retail stock by an additional 24,000 sqm. This new stock increase has also affected the shopping centre vacancy rate recorded to be 2.76% compared to 2.07% in H2 2016. There are mixed-use developments in the pipeline that will house retail on the ground floor. The retail stock is not predicted to change in the short term, but in the mid-term it should increase by an approximate 20%. The market is still eager to attract brands that are familiar to the consumer and well liked such as H&M, C&A, Debenhams, Marks and Spencer, etc.

My outlook for the Albanian property market is positive. We should see further growth in construction activity. Changes in the hospitality sector, where new branded hotels are expected to enter the market, are particularly interesting. This, of course, is seen as increased investor confidence in Albania's property market. Retail will see further expansion of international brands and office should not see any immediate changes but by 2019 the stock should definitely increase when the first wave of mixed-use projects comes into market.